Penerimaan (-BS)

Penerimaan (-BS) refers to a temporary receipt or voucher used to record the receipt or income that has not been formally recorded in the company's accounting system. This temporary receipt is commonly used to temporarily record cash receipts or payments from customers or other parties before being formally recorded in the accounting system.

Penerimaan (-BS) plays an important role in managing the cash flow of the company, as it allows for the temporary recording of direct receipts before being processed formally in the accounting system. Once officially recorded, Penerimaan (-BS) will be reflected in the financial statements and will impact financial analysis and reporting of the company.

In the context of "Bon Sementara," Penerimaan (-BS) records the amount of the receipt received and can be used as evidence or reference for the purpose of subsequent formal accounting and financial reporting.

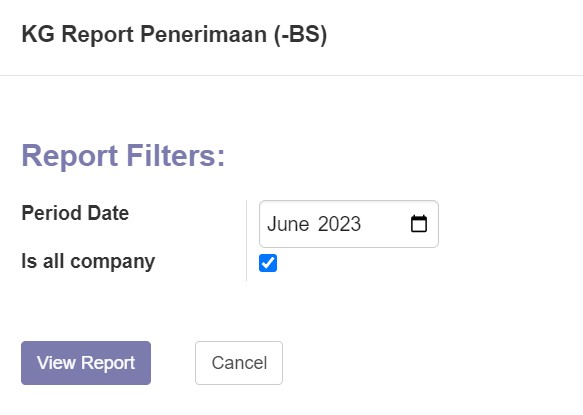

Is all company

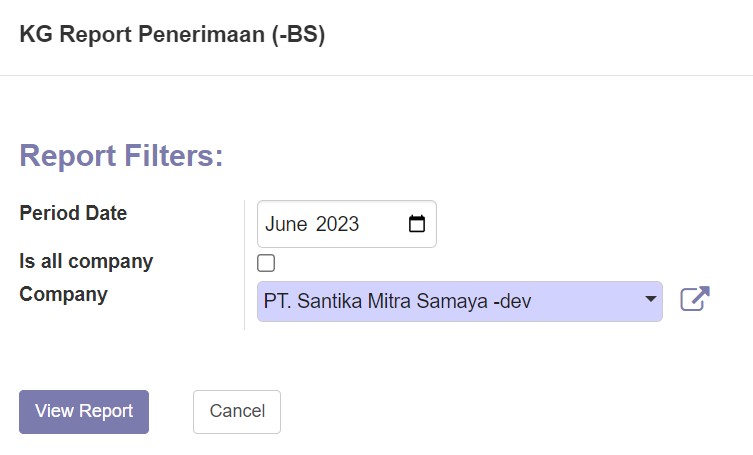

Specific company

Field "Period": The field "Period" represents a specific time frame or duration. It is commonly used to indicate a specific month and year. For example, if the field contains the value "June 2023," it indicates the period of time corresponding to the month of June in the year 2023. The "Period" field helps in organizing and referencing data based on specific time intervals, allowing for easier tracking and analysis of information within a particular timeframe.

Checkbox "Is All Company": The checkbox is used to mark or select the option that applies to all existing companies. When this checkbox is checked or selected, it indicates that the associated option or setting applies to all companies within the relevant context.

Field "Company": The field "Company" represents a specific company if the checkbox "Is All Company" is unchecked. It allows user to choose which company data that they want to check.

View Report (mrt)

View Report (Table/Grid)

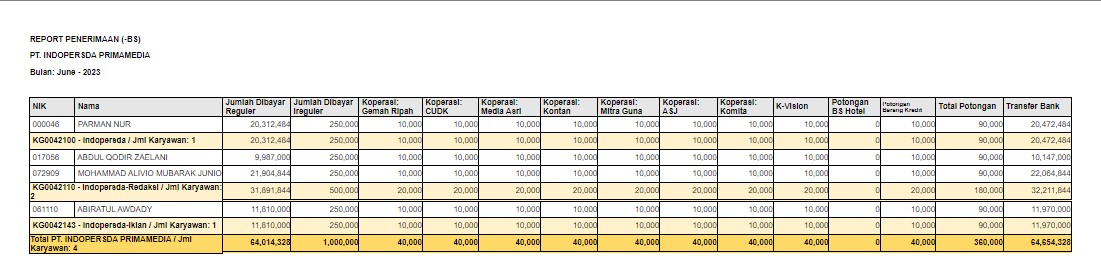

company_id: The field "company_id" represents the unique identifier or code assigned to a specific company in a system or database. It is used to link and associate records or transactions with the corresponding company.

company_name: The field "company_name" stores the name or title of the company. It provides the textual representation or label for the associated company_id, making it easier to identify and reference the company.

nik: The field "nik" stands for "Nomor Induk Karyawan" in Indonesian, which translates to "Employee Identification Number" in English. It is a unique identifier assigned to each employee within an organization. The "nik" field helps identify and differentiate employees based on their assigned employee number.

employee: The field "employee" typically stores the name or other relevant information about an employee. It represents the individual who is associated with the record or transaction.

dept: The field "dept" is short for "department" and is used to indicate the specific department or organizational unit to which an employee belongs. It helps categorize and organize employees based on their respective departments.

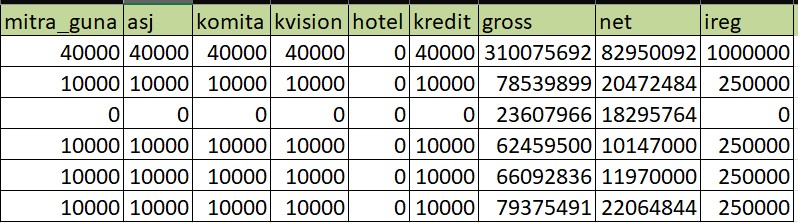

gemah_ripah, cudk, media_asri, kontan, mitra_guna, asj, komita, kvision, hotel, kredit: These fields appear to represent different categories or types of financial transactions or accounts. Each field is likely associated with a specific financial aspect or account within the company, such as "gemah_ripah" representing a certain type of financial activity or account.

gross: The field "gross" typically refers to the gross amount or total before any deductions or taxes are applied. It represents the total value or amount associated with a particular financial metric, such as gross income or gross revenue.

net: The field "net" refers to the net amount or total after deductions or taxes have been subtracted from the gross amount. It represents the final value or amount resulting from specific calculations or adjustments.

ireg: The field "ireg" appears to represent irregular income or irregular financial transactions. It likely captures specific types of income or financial activities that deviate from regular or predictable patterns.