Daftar Irregular

Daftar Irregular is a report that displays a list of irregular income that have been transferred, such as allowances, bonuses, and other non-regular income sources. This report provides an overview of the various types of additional income and allowances received, allowing for tracking and management of income that is not part of the regular salary or fixed income components.

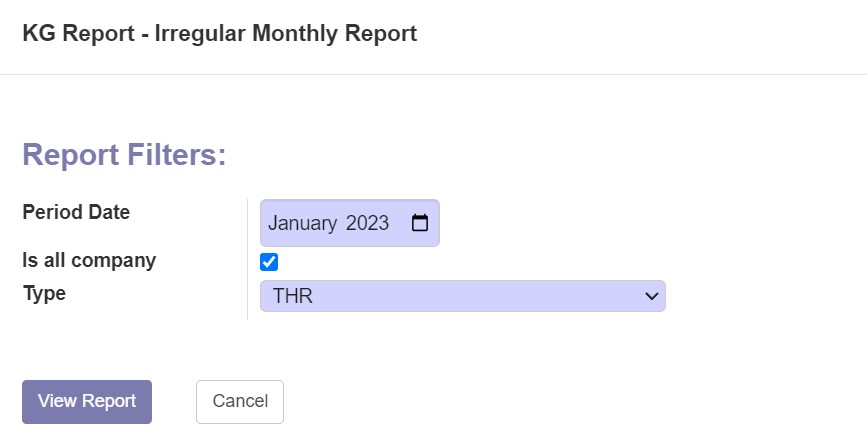

Is All Company

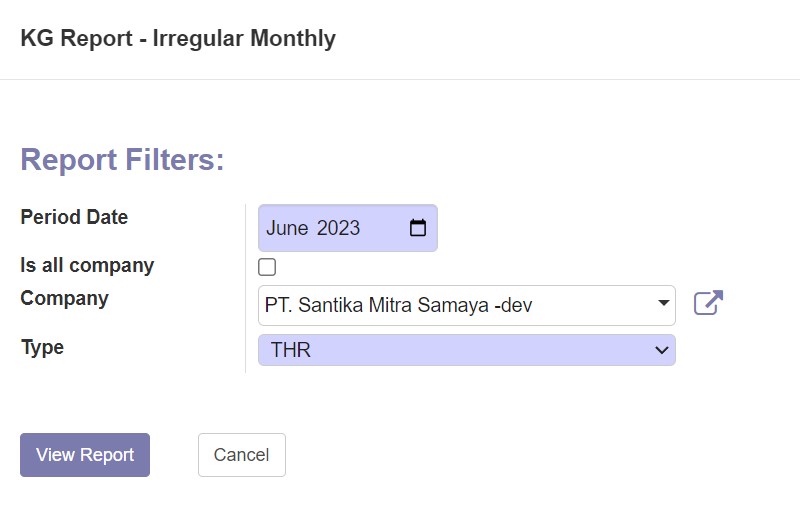

Specific Company

Field "Period": The field "Period" represents a specific time frame or duration. It is commonly used to indicate a specific month and year. For example, if the field contains the value "June 2023," it indicates the period of time corresponding to the month of June in the year 2023. The "Period" field helps in organizing and referencing data based on specific time intervals, allowing for easier tracking and analysis of information within a particular timeframe.

Checkbox "Is All Company": The checkbox is used to mark or select the option that applies to all existing companies. When this checkbox is checked or selected, it indicates that the associated option or setting applies to all companies within the relevant context.

Irregular Income Type: It is a field that identifies the types of irregular or non-regular income. This includes various types of additional income that are not part of fixed or routine income components. Examples of irregular income types include bonuses, promotion allowances, special incentives, additional commissions, or special awards.

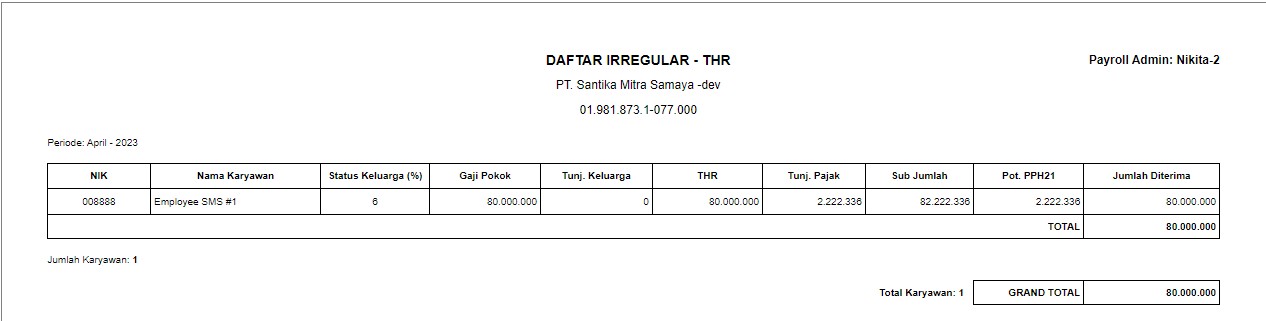

View Report (mrt)

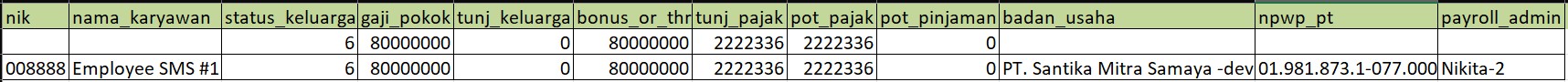

View Report (Table/Grid)

nik: The field "nik" stands for "Nomor Induk Karyawan" in Indonesian, which translates to "Employee Identification Number" in English. It is a unique identifier assigned to each employee within an organization. The "nik" field helps identify and differentiate employees based on their assigned employee number.

nama_karyawan: The field "nama_karyawan" represents the name of the employee. It stores the full name or other relevant personal information of the employee associated with the record or transaction.

status_keluarga: The field "status_keluarga" refers to the marital status or family status of the employee. It indicates whether the employee is single, married, divorced, or in another marital status category.

gaji_pokok: The field "gaji_pokok" represents the basic salary or base wage of the employee. It refers to the fixed amount of compensation that the employee receives before any additional allowances or deductions.

tunj_keluarga: The field "tunj_keluarga" represents the family allowance or family support allowance provided to the employee. It refers to an additional payment or benefit given to employees who have dependents or family members to support.

bonus_or_thr: The field "bonus_or_thr" refers to bonuses or other forms of additional compensation provided to the employee. It includes special incentives, performance-based bonuses, or one-time payments such as year-end bonuses or annual performance bonuses.

tunj_pajak: The field "tunj_pajak" represents tax allowances or tax-related benefits provided to the employee. It refers to specific allowances or benefits designed to help employees manage their tax obligations.

pot_pajak: The field "pot_pajak" represents tax deductions or withholding tax applied to the employee's salary or income. It refers to the amount of tax that is deducted from the employee's earnings before receiving the net pay.

pot_pinjaman: The field "pot_pinjaman" represents loan deductions or deductions related to employee loans. It includes any repayments or deductions made from the employee's salary to cover loan payments or outstanding loan amounts.

badan_usaha: The field "badan_usaha" refers to the legal entity or business entity associated with the employee. It represents the organization or company that the employee is employed by.

npwp_pt: The field "npwp_pt" represents the Taxpayer Identification Number (Nomor Pokok Wajib Pajak) of the employing company or organization. It is a unique identification number assigned to businesses or entities for tax purposes.

payroll_admin: The field "payroll_admin" refers to the payroll administrator or the person responsible for managing and processing payroll-related tasks and activities within the organization. It typically denotes the individual or department handling payroll matters.