Monthly Payroll - Pivot

General Description

The Monthly Payroll - Pivot Report is a monthly payroll report presented in the form of a pivot table. This report allows users to view employee payroll data in a dynamic table that can be customized as needed.

In this pivot report, payroll data can be organized based on specific criteria such as department, position, or salary type. Users can also add new columns, change grouping types, and apply filters to narrow down the data scope.

With this pivot report, users can easily analyze payroll data comprehensively and make informed decisions based on the information provided.

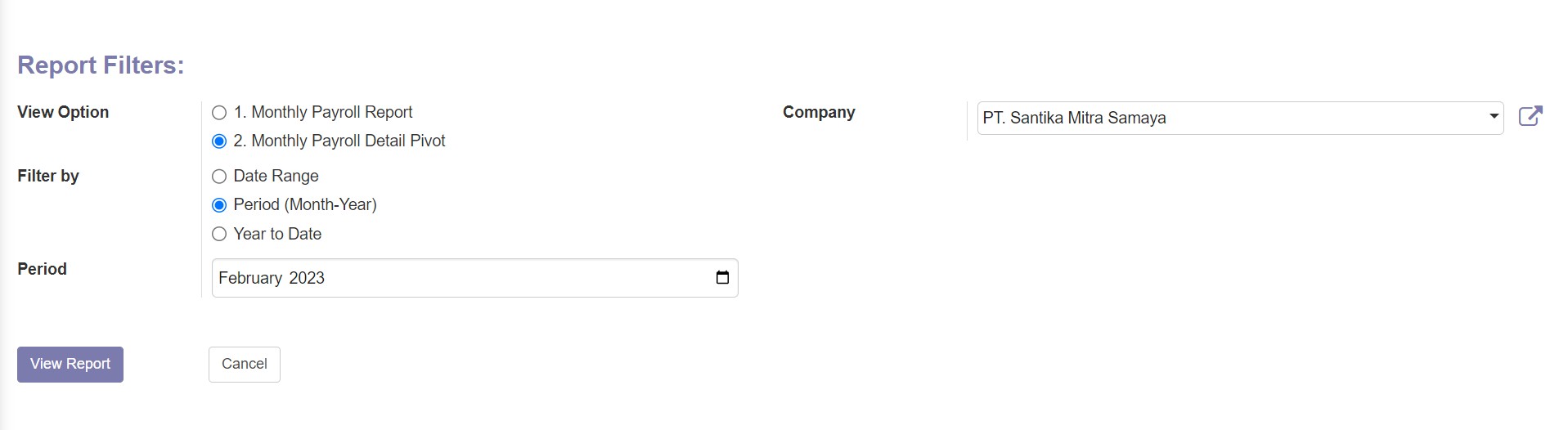

Monthly Payroll - Pivot Report has two view options: Monthly Payroll Report and Monthly Payroll Detail Pivot. The Monthly Payroll Report shows the main components of the employee's salary, while the Monthly Payroll Detail Pivot displays a more detailed breakdown of the employee's earnings and deductions.

Monthly Payroll-Pivot Report can be filtered by three options, namely Date Range, Period (month-Year), and Year to Date. Date Range filter allows users to select a specific date range, such as a month or a quarter, to view payroll data. Period filter allows users to select a specific month and year to view payroll data. Year to Date filter allows users to view payroll data for the entire year up to the current date.

Users can choose which company's payroll data they want to view in the Monthly Payroll-Pivot Report by selecting the company from the company dropdown field. Users can only view payroll data for companies that are registered as an allowed company for the user. This ensures that users only have access to payroll data for companies that they are authorized to view.

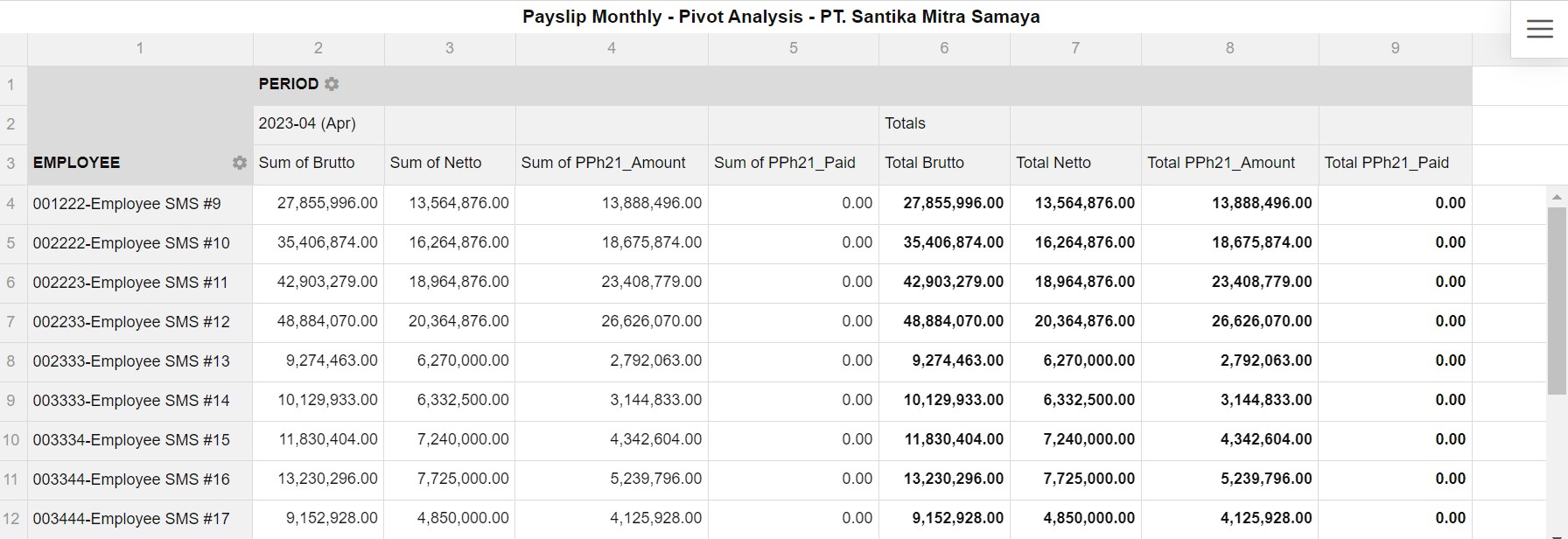

Monthly Payroll Report

These are the These are the fields reported in Monthly Payroll Report

Sum of Brutto: This refers to the total amount of gross salary earned by all employees within a certain time period. It includes basic salary, allowances, bonuses, and other benefits before any deductions are made.

Sum of Netto: This refers to the total amount of net salary earned by all employees within a certain time period. It is the amount of salary that employees actually receive after all deductions, such as taxes, social security contributions, and other mandatory deductions, are taken out of their gross salary.

Sum of PPh21_Amount: This refers to the total amount of tax (Pajak Penghasilan or PPh) that has been calculated for each employee based on their gross salary and applicable tax rates.

Sum of PPh21_Paid: This refers to the total amount of tax (Pajak Penghasilan or PPh) that has been paid by each employee during a certain time period. It includes both the employee's own contributions and any employer contributions towards the employee's taxes.

Total Brutto: This refers to the overall total amount of gross salary earned by all employees over a longer time period, such as a year or fiscal year. It provides a comprehensive view of the company's payroll expenses.

Total Netto: This refers to the overall total amount of net salary earned by all employees over a longer time period, such as a year or fiscal year. It provides a comprehensive view of the actual amount of money that employees receive after taxes and other deductions.

Total PPh21_Amount: This refers to the total amount of tax (Pajak Penghasilan or PPh) that has been calculated for all employees over a longer time period, such as a year or fiscal year.

Total PPh21_Paid: This refers to the total amount of tax (Pajak Penghasilan or PPh) that has been paid by all employees over a longer time period, such as a year or fiscal year. It includes both employee and employer contributions towards the employees' taxes.

Monthly Payroll Detail Pivot

These are the fields reported in Monthly Payroll Detail Pivot Report

-5a60925ddeaa9108f00f5819c093c385.jpg)

Gaji - Basic salary or wage that an employee receives for their work during a certain period.

PHDP - Penghasilan tidak kena pajak (Tax-exempt income) which is an amount of income that is not subject to income tax.

SIMPONI - An additional payment or bonus given to employees based on company or individual performance.

Tunj. Transport Bulanan - Monthly transportation allowance given to employees to cover their transportation costs.

Tunj. Tetap - Fixed allowance given to employees in addition to their basic salary.

Tunj. Jabatan - An allowance given to employees for holding a specific position or job title within the company.

Tunj. Khusus Jabatan - A special allowance given to employees for holding a specific position or job title that requires certain skills or expertise.

Tunj. Daerah - An allowance given to employees who work in a certain region or area where the cost of living is higher.

Tunj. Tidak Tetap - Non-fixed allowance given to employees in addition to their basic salary.

Tunj. Operasional - An allowance given to employees to cover their operational expenses such as communication, internet, or other necessary costs.

Tunj. Mutasi - An allowance given to employees who have been relocated or transferred to a different location.

Tunj. Pulsa - An allowance given to employees to cover their communication costs such as mobile phone bills.

BTDL - Biaya-biaya yang dikeluarkan langsung (Direct expenses) which is the cost of goods or services that are directly related to producing a product or service.

BTDL Penyusutan - The depreciation of direct expenses over time.

Tunj. Keluarga - An allowance given to employees who have dependents such as a spouse or children.

Gratifikasi - A gift or bonus given to employees as a token of appreciation or for a job well done.

Uang Makan / Hadir - Meal allowance given to employees when they attend a meeting or work overtime.

Tunj. Nikah - An allowance given to employees who get married.

Bantuan Uang Sekolah Anak - An allowance given to employees to cover their children's education expenses.

Upah Lembur - Overtime pay given to employees who work beyond their regular working hours.

Tunj. Lain - lain Medical - Other medical allowance given to employees for medical expenses that are not covered by insurance.

Potongan Covid - Deduction of salary due to Covid-related issues such as reduction of working hours or business closures.

Susulan - Backpay or salary arrears that were not paid in previous periods.

Tunj. Cuti Besar - An allowance given to employees who take a long period of leave, usually more than one month.

Tunj. Kalpika Cincin (+) - An additional allowance given to employees as a reward or recognition for their long service or loyalty to the company.

Insentif - An incentive or bonus given to employees as a motivation for achieving specific targets or goals.

Tunj. Kesehatan Pensiun (+) - An additional health allowance given to employees who have retired from the company.

Cadangan - Reserves or set-asides in the company's budget for future expenses or emergencies.

Tunjangan Hari Raya - Allowance given to employees during certain holidays such as Eid Al-Fitr or Christmas.

Bonus - An additional payment or reward given to employees for their performance or as an incentive.

Bonus Khusus: This is a special bonus given to employees for exceptional performance or contribution.

Bonus PK: This is a bonus given to employees for achieving specific sales targets.

Tunj. Kalpika: This is an allowance given to employees for the purchase of jewelry or other luxury items.

Bonus Proyek: This is a bonus given to employees for the successful completion of a specific project.

Asuransi Premi: This is a deduction made from the employee's salary for their health or life insurance premium.

THT Perusahaan: This is a contribution made by the company towards the employee's retirement savings plan.

BPJS-JP-Perusahaan: This is a contribution made by the company towards the employee's government-mandated retirement savings plan.

BPJS-Kes-Perusahaan: This is a contribution made by the company towards the employee's government-mandated health insurance plan.

THT Karyawan: This is a contribution made by the employee towards their own retirement savings plan.

BPJS-JP-Karyawan: This is a contribution made by the employee towards their own government-mandated retirement savings plan.

BPJS-Kes-Karyawan: This is a contribution made by the employee towards their own government-mandated health insurance plan.

Susulan (-): This is a negative adjustment made to an employee's salary for previous errors or omissions in payroll calculations.

Cadangan (-): This is a deduction made from the employee's salary to replenish the company's reserve fund.

Bonus atas Cadangan: This is a bonus given to employees for exceptional performance that contributes to the company's reserve fund.

Angsuran Pinjaman: This is a deduction made from the employee's salary for repayment of a loan taken from the company.

Angsuran Pinjaman Lain-lain: This is a deduction made from the employee's salary for repayment of a loan taken from a third-party lender.

Pot. TTB: This is a deduction made from the employee's salary for their contribution towards a social security program for informal workers.

Angsuran Pinjaman Mobil Dinas: This is a deduction made from the employee's salary for repayment of a loan taken to purchase a company car.

Angsuran Pinjaman Motor Dinas: This item refers to a deduction made from an employee's gross salary to repay a loan taken out by the employee for a company-provided motorbike. This type of loan is commonly offered as an employee benefit in Indonesia, especially for those who need to commute frequently for work. The repayment of the loan is usually done through monthly deductions from the employee's salary until the loan is fully paid off. The amount of the deduction is based on the loan amount and repayment terms agreed upon by the employer and employee.

Tunjangan Lain-lain Medical (-): This refers to any miscellaneous medical allowances that are deducted from the employee's salary.

Tunjangan Kalpika Cincin (-): This refers to any deductions made from the employee's salary for a ring that they may have purchased through the company's Kalpika program.

Potongan IDTP: This is a deduction made from the employee's salary for IDTP (Indemnity Death and Total Permanent Disability Program) insurance.

Potongan Cuti Melahirkan: This is a deduction made from the employee's salary for any maternity leave taken.

Tunj Kesehatan Pensiun (-): This refers to any deductions made from the employee's salary for their health insurance and pension plan.

Bonus (-): This refers to any bonus that has been given to the employee, but is being deducted from their salary for a particular reason. For example, if the employee has received a bonus for achieving a certain target, but later it was found out that they did not achieve the target fairly, then the bonus may be deducted from their salary. The amount deducted will be listed as a negative value under this item in the payslip.

Total Tunjangan: This is the total amount of all the allowances (or deductions) listed above.

PTKP: This stands for "Penghasilan Tidak Kena Pajak" in Indonesian, which translates to "Non-Taxable Income". It is the amount of money that is exempted from taxation.

PKP: This stands for "Penghasilan Kena Pajak" in Indonesian, which translates to "Taxable Income". It is the amount of money that is subject to taxation.

PPH21: This stands for "Pajak Penghasilan 21" in Indonesian, which translates to "Income Tax 21". It is the amount of income tax that the employee must pay based on their taxable income.

Gross Taxable: This is the employee's taxable income before any tax deductions or exemptions are applied.

NET + EVENT: This is the employee's net salary plus any event bonuses or other incentives that they may have received.

Net Salary: This is the employee's salary after all deductions and taxes have been taken out.

Iuran Pensiun Perusahaan: This is the amount of money that the company contributes to the employee's pension plan.

Pensiun Manfaat Pasti (R) (+): This refers to any additional pension benefits that the employee may be entitled to receive based on their years of service.

Iuran Pensiun Karyawan: This is the amount of money that the employee contributes to their own pension plan.

Pensiun Manfaat Pasti (E): This refers to any pension benefits that the employee may be entitled to receive based on their years of service.

Total Amount: This is the total amount of money that the employee receives as their net salary after all deductions, taxes, and other contributions have been taken into account.

Filter Input

Date Range

-a188d75408ec9493b761df9b5e879db0.jpg)

The Date Range filter allows users to select a specific range of dates within a month. For example, users can choose to view payroll data from the 1st to the 15th of a specific month or from the 16th until the end of the month. This filter helps users narrow down the scope of the data for easier analysis.

Period (Month-Year)

-b27d57a182fa530f21dc4683f4f79e85.jpg)

The Period filter enables users to select a specific month and year to view their payroll data. For instance, users can choose to view payroll data for January 2022 or December 2021. This filter helps users examine payroll data within a specific month and year period.

Year to Date

-637fa16c76c93efa1ffd3753eb92b318.jpg)

The Year to Date filter allows users to view payroll data from the beginning of the year up to the current date. This filter helps users analyze payroll data over a longer time span and compare the performance of employees or departments over time.

The Date Range and Year to Date filters essentially use the same input type and can be filled with the same values. The difference between these two filters lies in their default input values.