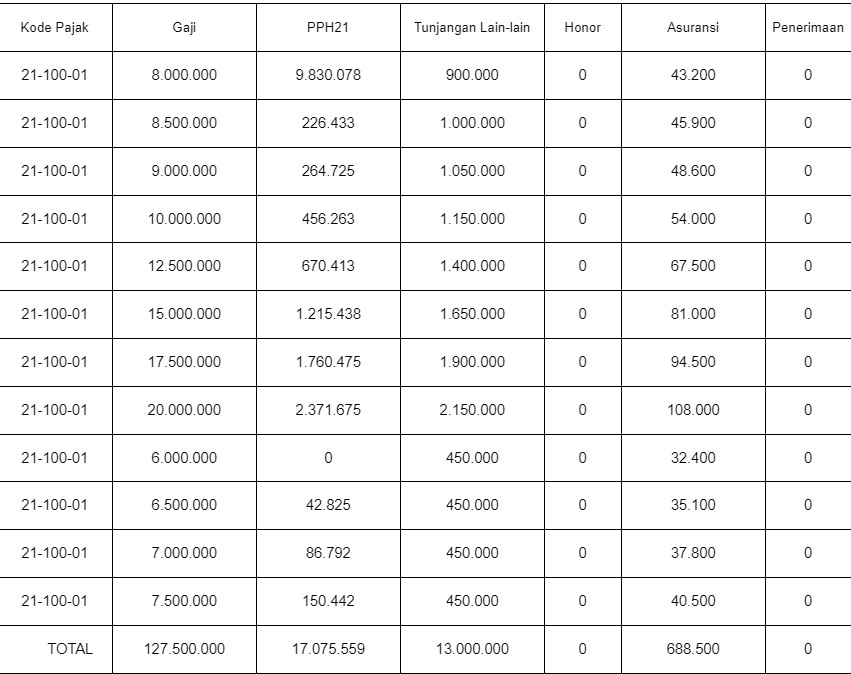

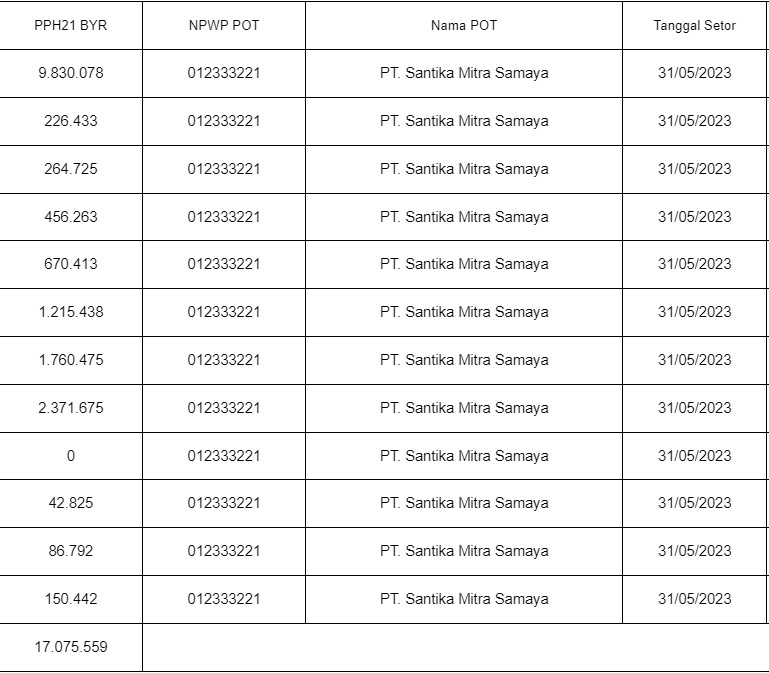

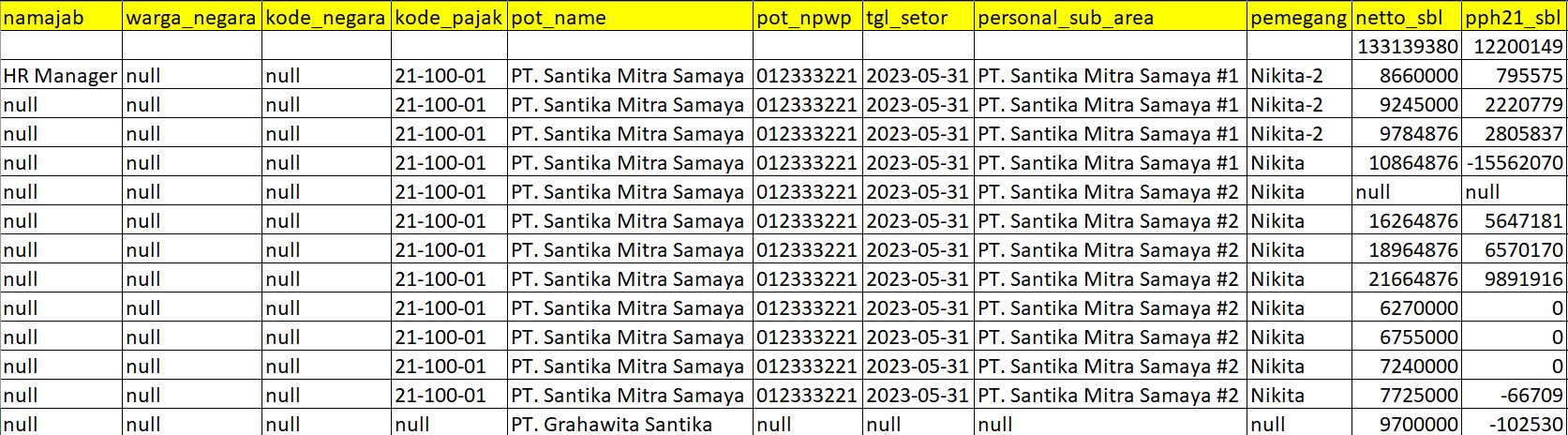

Daftar SPT Masa

The SPT Masa Report is a document that provides information regarding the Periodic Tax Return (SPT) submitted by individuals or businesses to the tax authorities. It includes details such as the submission date, reported tax period, earned income, tax payments made, and the status of the SPT Masa (such as received, under verification, or submitted). This report serves as evidence of tax compliance and is used by tax authorities to verify and ensure tax compliance. It helps individuals or businesses monitor and record tax payments, ensuring accuracy and completeness in fulfilling their tax obligations. The main purpose of the SPT Masa Report is to facilitate tax monitoring and reporting in accordance with tax regulations, enabling individuals or businesses to manage their tax obligations and comply with applicable tax rules.

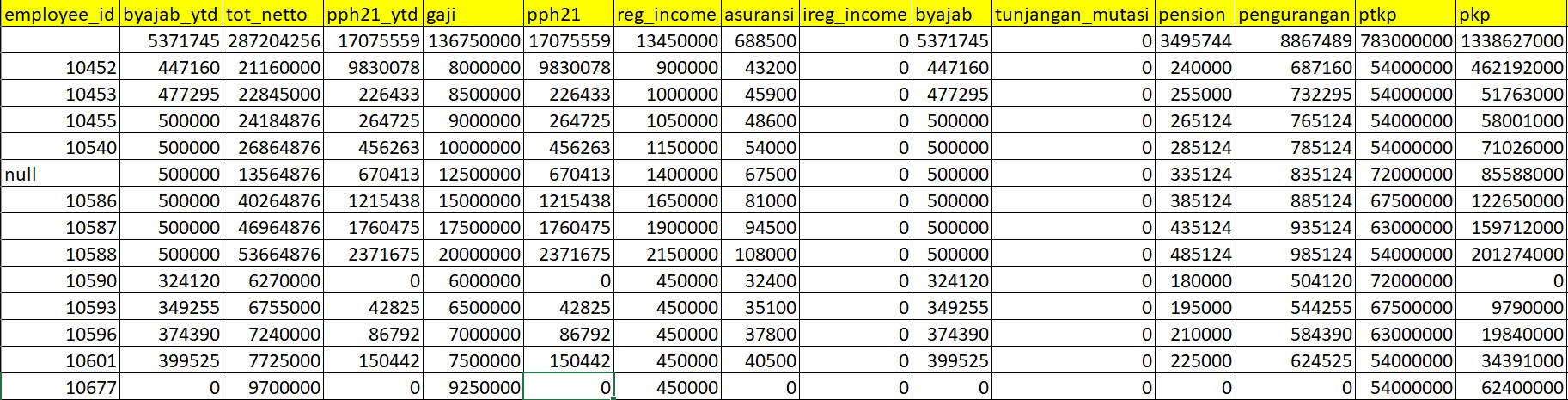

View Report (mrt)

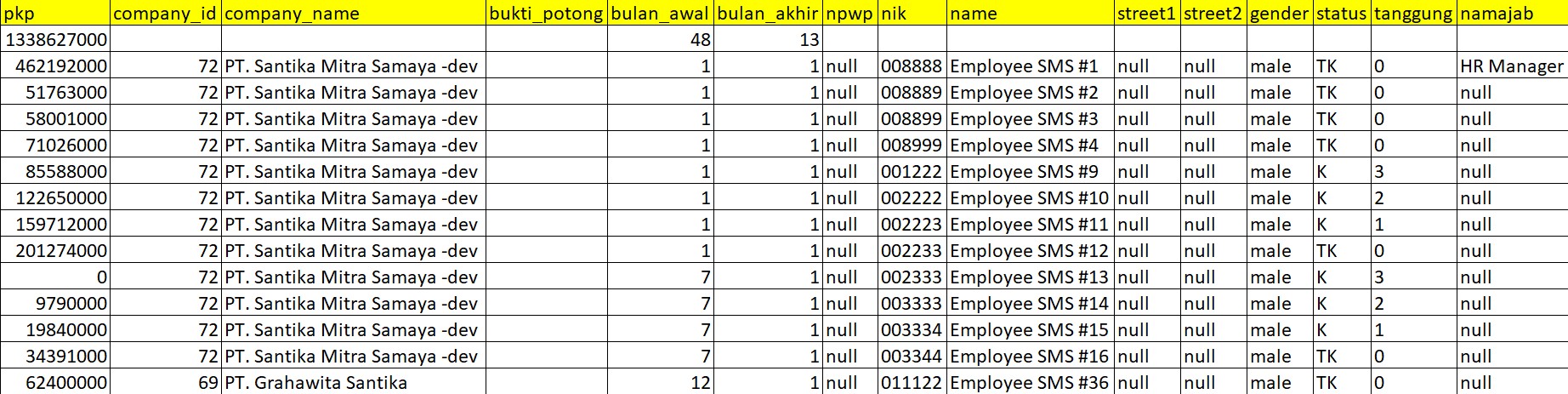

View Report (Table/Grid)

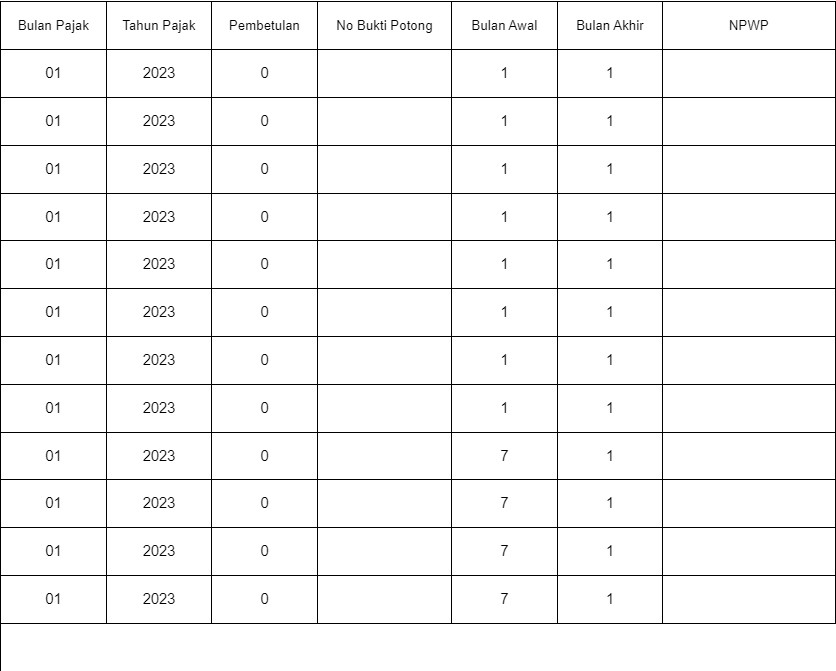

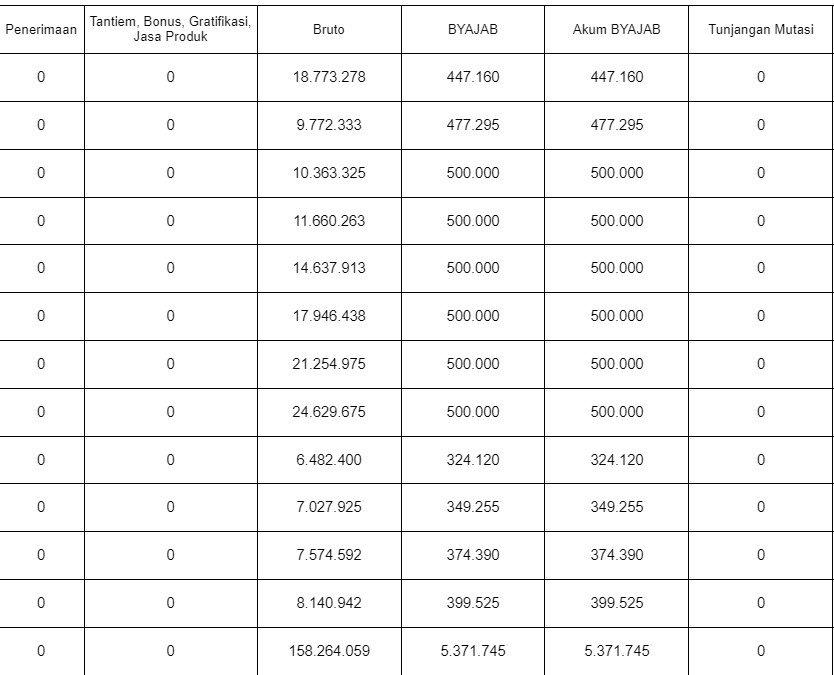

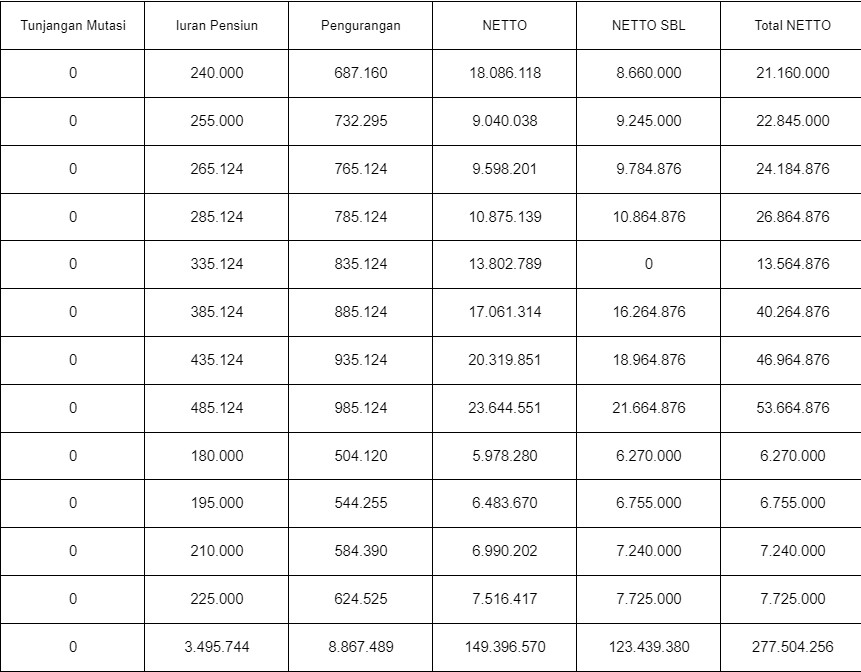

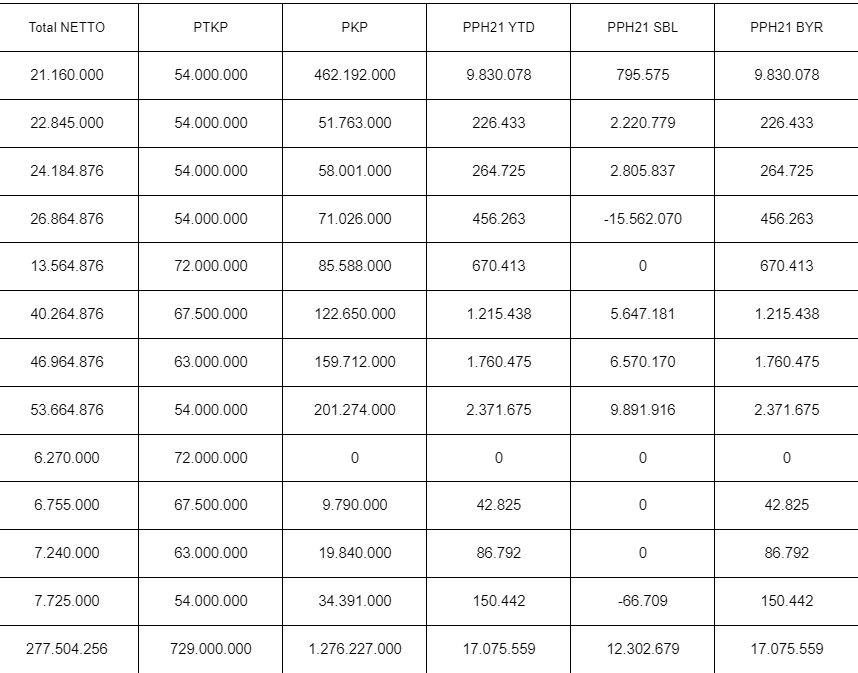

Here is an explanation of the fields in the SPT Masa Report:

- employee_id: The identification number or code assigned to the employee.

- byajab_ytd: Year-to-date value of the employee's allowance for special expenses.

- tot_netto: Total net income earned by the employee.

- pph21_ytd: Year-to-date value of the employee's income tax (PPH21) payment.

- gaji: The employee's salary.

- pph21: The income tax (PPH21) amount withheld from the employee's salary.

- reg_income: Regular income earned by the employee.

- asuransi: Insurance-related deductions or contributions.

- ireg_income: Irregular income earned by the employee.

- byajab: Allowance for special expenses.

- tunjangan_mutasi: Allowance for job transfer or relocation.

- pension: Pension-related deductions or contributions.

- pengurangan: Other deductions or reductions.

- ptkp: The employee's tax allowance or tax credit.

- pkp: The employee's taxable income after deducting the tax allowance (PTKP).

- company_id: The identification number or code assigned to the company.

- company_name: The name of the company.

- bukti_potong: Proof of tax withholding or tax deduction.

- bulan_awal: The starting month of the tax period.

- bulan_akhir: The ending month of the tax period.

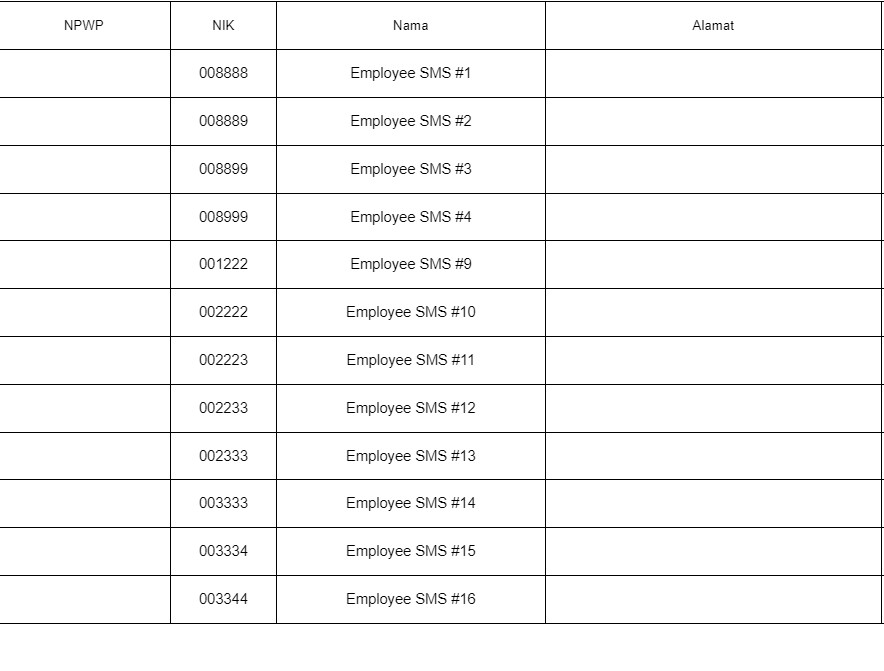

- npwp: The employee's Taxpayer Identification Number.

- nik: The employee's National Identification Number.

- name: The employee's name.

- street1: The employee's address line 1.

- street2: The employee's address line 2.

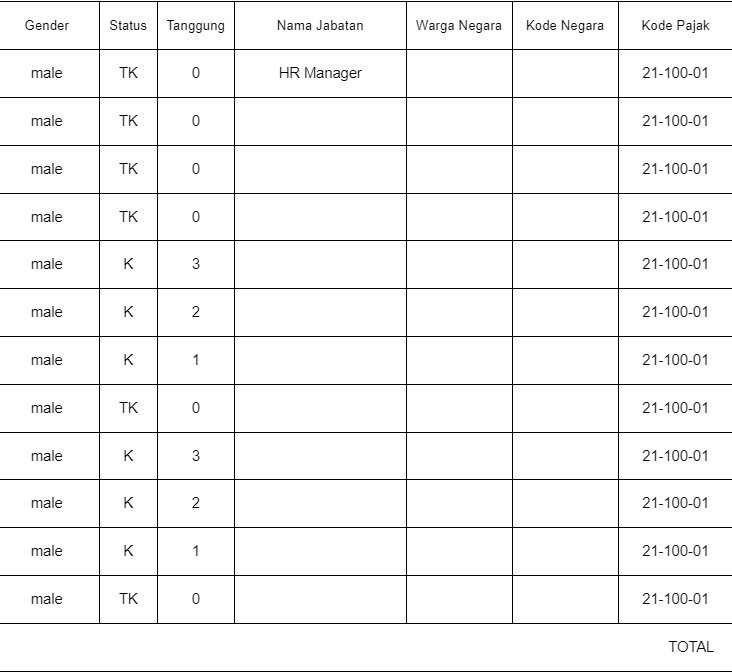

- gender: The employee's gender.

- status: The employee's marital status.

- tanggung: The number of dependents or individuals supported by the employee.

- namajab: The employee's job position or title.

- warga_negara: The employee's nationality.

- kode_negara: The country code.

- kode_pajak: The tax code.

- pot_name: The name of the deduction or reduction.

- pot_npwp: The Taxpayer Identification Number associated with the deduction or reduction.

- tgl_setor: The date of tax payment or deposit.

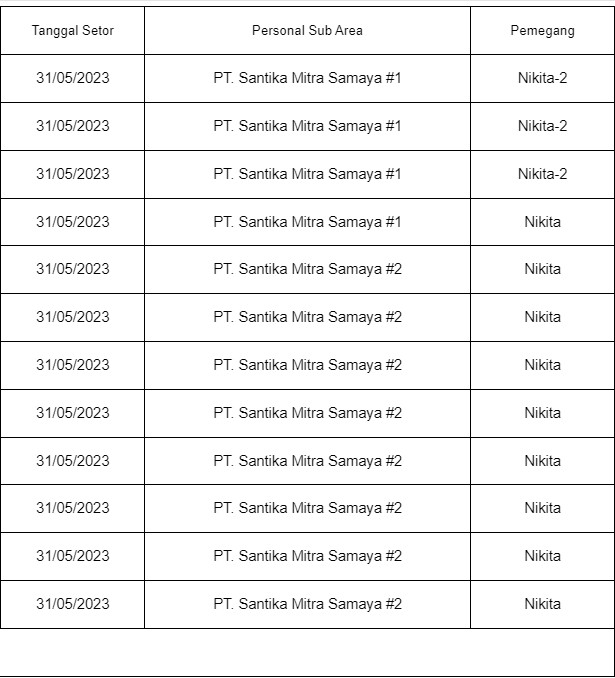

- personal_sub_area: The employee's sub-area or subdivision.

- pemegang: The employee's status as a tax withholding agent.

- netto_sbl: The previous period's net income.

- pph21_sbl: The previous period's income tax (PPH21) amount.