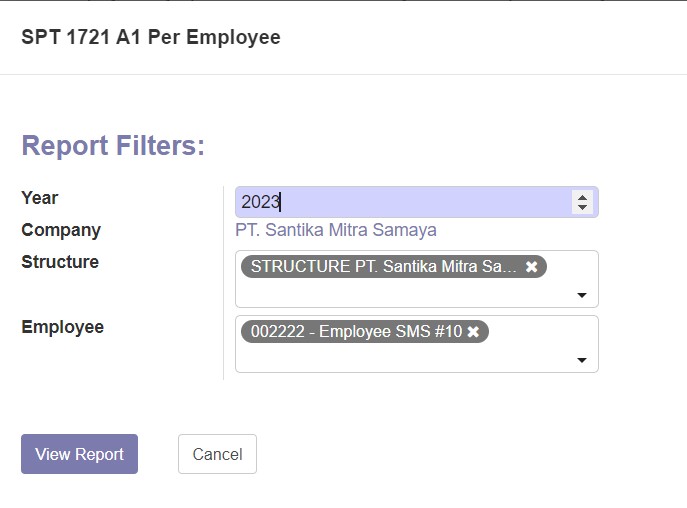

SPT 1721 A1 Per Employee

General Description

SPT 1721 A1 Per Employee is Odoo Payroll KG feature that functioned to generate SPT 1721 A1 for employees. Reported from the klikpajak.id site, 1721 A1 form is the proof of withholding income tax article 21 for 1 tax year or as long as the employee continues to work for the tax provider during the tax year. 1721 A1 form will be used by permanent employees in reporting an individual's Annual Income Tax Return.

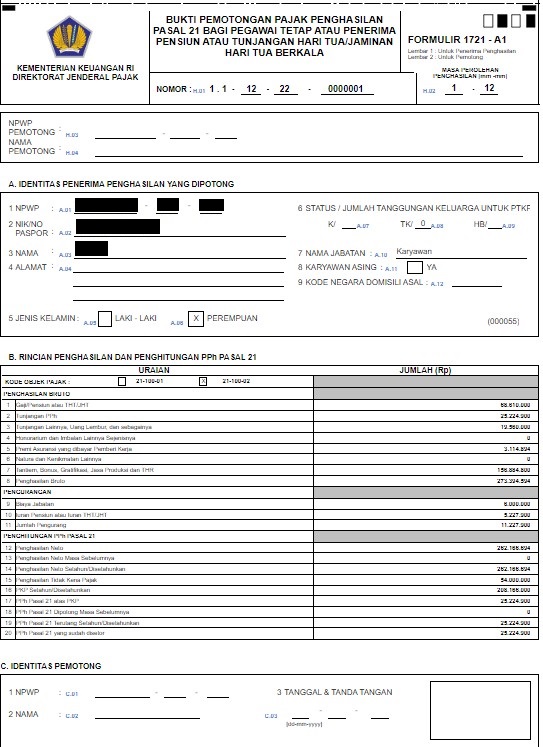

The generated SPT 1721 A1 will be like the picture below.

The format fields of SPT 1721 A1 per employee are as follows:

Identitas Pribadi (Personal Identity): Includes the employee's name, address, and Tax ID Number (NPWP).

Penerimaan Gaji dan Upah (Salary and Wage Receipts): Includes the total amount of gross income received by the employee, such as basic salary, bonuses, and allowances.

Potongan (Deductions): Includes the total amount of tax deductions made by the employer, such as income tax, social security contributions, and other statutory deductions.

Penghasilan Neto (Net Income): Includes the net income received by the employee after all deductions have been made.

Surat Setoran Pajak (Tax Payment Receipt): Includes details of any tax payments made by the employer on behalf of the employee.

Informasi Tambahan (Additional Information): Includes any additional information that may be required, such as details of tax allowances or deductions for specific purposes.

Identitas Pemotong (The taxpayer's identity) : the taxpayer's identity as the withholder must be filled in completely and correctly, including the taxpayer's tax identification number (NPWP) and full name. After that, the recipient's identity to be reported must also be filled in completely and correctly, such as the full name, NPWP, and type of income received. So, the information on the taxpayer's identity is included in the SPT 1721 A1 form. It is important to note that the exact format and requirements of the SPT 1721 A1 may vary depending on the regulations and requirements set by the Directorate General of Taxes in Indonesia.

To know more about SPT 1721 A1, you can click here

Basically, this feature will generate the SPT 1721 A1 for the employees of a company so they do not have to manually calculate the report. All of the data generated from employee payslips.