SPT

"Surat Pemberitahuan" or abbreviated as SPT is a letter used by Taxpayers to report tax calculations and/or payments, tax objects and/or non-tax objects, as well as assets and liabilities in accordance with the provisions of the applicable tax laws and regulations. All information contained in the SPT must be correct, complete and clear. SPT can be reported directly to the "Kantor Pelayanan Pajak" (KPP) or via online.

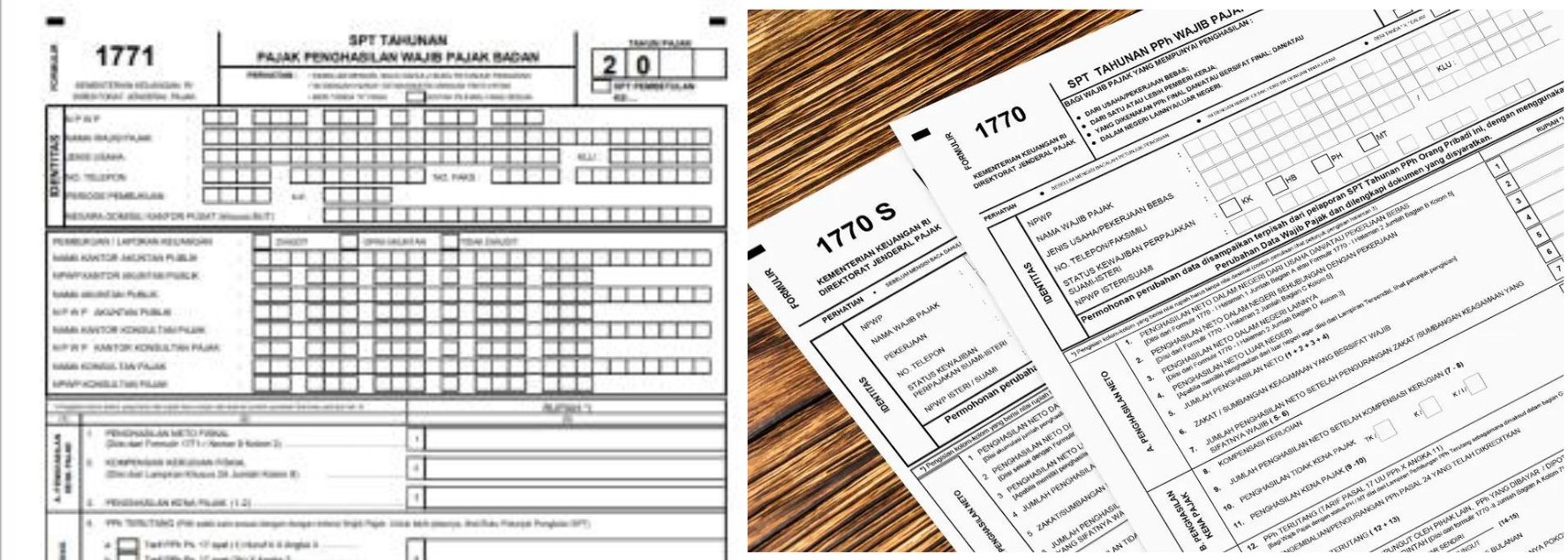

Based on the provisions of laws and regulations, there are 2 (two) types of SPT, namely SPT Masa and SPT Tahunan. Meanwhile, SPT Masa consisting of SPT Masa PPh , SPT Masa PPN, and SPT Masa PPN for PPN collectors. While the SPT Tahunan includes the Annual SPT of Individuals and the Annual SPT of the Agency.

To Check more details about SPT, click here