Werks Eligible

General Description

The module is created by Kompas Gramedia to enable remuneration calculation based on rules that defined in the form werks and eligible. The goal is to replicate werks eligible function from SAP to help automate remuneration calculation. Employees > Configuration > Werks Eligible

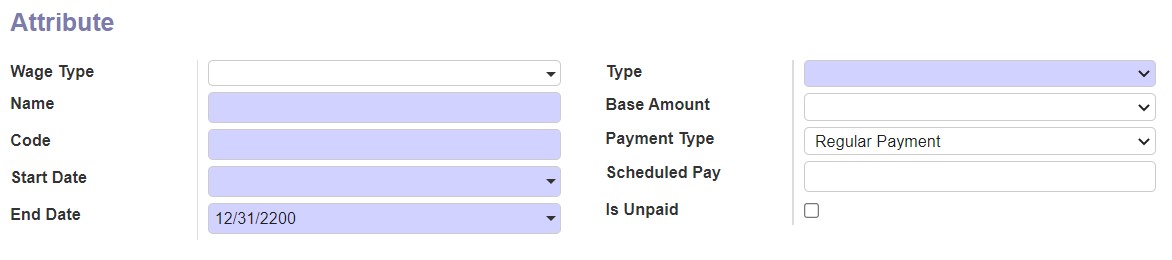

The attribute eligibilities consists of:

- Wage Type

- Name

- Code

- Start Date

- End Date

- Type

- Base Amount

- Payment Type

- Scheduled Pay - currently unused

- Is Unpaid

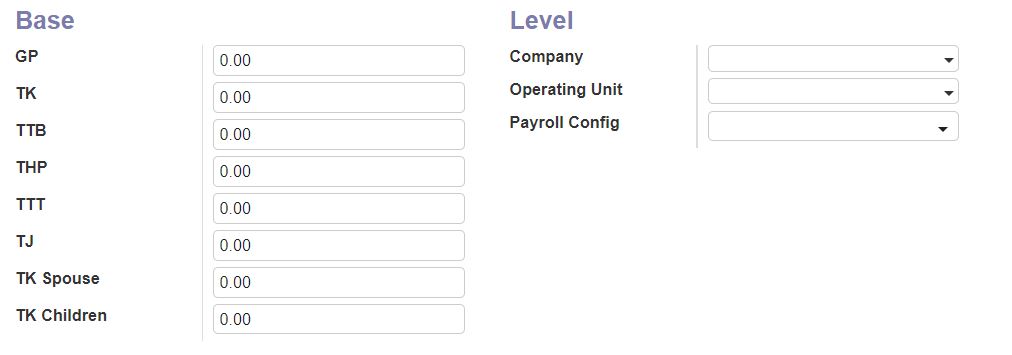

The Base eligibilities consists of:

- GP (Gaji Pokok)

- TK (Tunjangan Keluarga)

- TTB (Tunjangan Transport Bulanan)

- THP (Tunjangan HP/Pulsa)

- TTT (Tunjangan Tidak Tetap)

- TJ (Tunjangan Jabatan)

- TK Spouse (Tunjangan Keluarga Istri)

- TK Children (Tunjangan Keluarga Anak)

The Level eligibilities consists of:

- Company

- Operating Unit

- Payroll Config

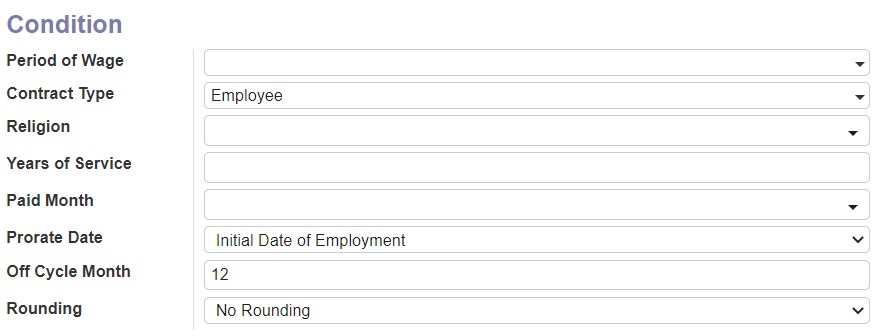

The Condition eligibilities consists of:

- Period of Wage

- Contract Type

- Religion

- Years of Service

- Paid Month

- Prorate Date

- Off Cycle Month

- Rounding

Remuneration Type

There are 3 types of werks eligible. Each type will determine the remuneration data processing, which includes:

- Integer

- Number

- Text

- Calculation

- Get from SAP

Payment Type

Payment type selection in werks eligible which type is "Calculation" will defined where the remuneration type the component is.

There are 2 types of payment type in Attribute Eligibilities:

- Regular Payment. If selected type of payment type is regular payment, the remuneration will be categorized as regular payment and will be automatically insert into Salary Computation. The assumption of regular payment, the remuneration will be transferred along with monthly payroll.

- Irregular Payment. If selected type of payment type is irregular payment, the remuneration will be categorized as irregular payment and will be automatically insert into Salary Input. The assumption of irregular payment, the remuneration will be transferred separately from monthly payroll.

Base Amount

Base amount selection in werks eligible will defined where the base amount of remuneration calculation will be taken.

There are 2 types of base amount in Attribute Eligibilities:

- Contract. If selected type of base amount is contract, the base amount used in remuneration calculation will be taken from employee's contract.

- Payslip. If selected type of base amount is payslip, the base amount used in remuneration calculation will be taken from payslip. The period of payslip that is going to be taken as base amount will depends on selection of field Period of Wage in Condition Eligibilities.

Base for Contract Amount

As explained, if the werks eligible base amount set as Contract, the base amount will be taken from employee's contract. Here is the detail for each field base calculation:

- GP (Gaji Pokok) - contract.wage

- TK (Tunjangan Keluarga) - should not be taken from contract, because the component is also a result from werks eligible calculation of regular payment.

- TTB (Tunjangan Transportasi Bulanan) - contract.transportation

- THP (Tunjangan HP) - contract.mobile

- TTT (Tunjangan Tidak Tetap) - should not be taken from contract, because the component is manually uploaded into contract temp attribute and will be pulled into payslip.

- TJ (Tunjangan Jabatan) - contract.position

- TK Spouse (Tunjangan Keluarga Istri)

- TK Children (Tunjangan Keluarga Anak)

Base for Payslip Amount

As explained, if the werks eligible base amount set as Payslip, the base amount will be taken from employee's payslip. Here is the detail for each field base calculation:

- GP (Gaji Pokok) - payslip with code BASIC

- TK (Tunjangan Keluarga) - payslip with code R1003

- TTB (Tunjangan Transportasi Bulanan) - payslip with code R2003

- THP (Tunjangan HP) - payslip with code R3056

- TTT (Tunjangan Tidak Tetap) - payslip with code R1008

- TJ (Tunjangan Jabatan) - payslip with code R1006

- TK Spouse (Tunjangan Keluarga Istri) - will not be used as calculation in irregular payment. The total amount is already being placed in payslip with code R1003

- TK Children (Tunjangan Keluarga Anak) - will not be used as calculation in irregular payment. The total amount is already being placed in payslip with code R1003

Proporsional Calculation

The proporsional amount calculation of remuneration will be depends on 2 fields filled: Prorate Date and Off Cycle Month. In prorate date there are 3 options available which are going to be the base date of proporsional calculation:

- Contract Start Date

- Facility Date

- Initial Employment Date

The other fields, Off Cycle Month, will be the divider of the proporsional percentage. Usually will be filled with 12, since currently the rule of proporsional amount of remuneration will be based on a year or 12 months. Except for bonus which regulated per 6 months, so the field of Off Cycle Month will be filled with value 6.

The proporsional month calculated with formula:

For example: Paid month = April (4), Initial of Employment = February (2). Based on formula calculation, the proportional month should be 3 (February, March, April).

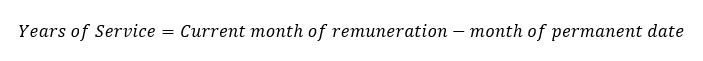

Years of Service

For specific years of service, the computation remuneration process will compute years of service for each employee before decide if the employee eligible to the remuneration. Formula used in years of service is:

The employee with the exact amount years of service (e.g 10 years) will be eligible for the remuneration.

Rounding Process

Add new option in Condition eligibilities of "Rounding", with available option:

- No Rounding

- Rounding to Hundreds

- Rounding to Thousands

All option of rounding available is only up rounding. No down rounding.