Business Process

Chart of Accounts Type

- Receivable

- Payable

- Bank and Cash

- Credit Card

- Current Assets

- Non-current Assets

- Prepayments

- Fixed Assets

- Current Liabilities

- Non-current Liabilities

- Equity

- Current Year Earnings

- Other Income

- Income

- Depreciation

- Expenses

- Cost of Revenue

Hospitality Implementation

In Odoo implementation for Hospitality group, the chart of accounts used in legacy apps were consists of:

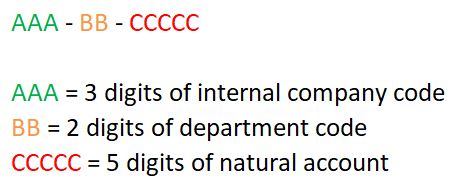

After using Odoo for replacing the legacy apps, for Hospitality group implementation, the chart of accounts structural becomes:

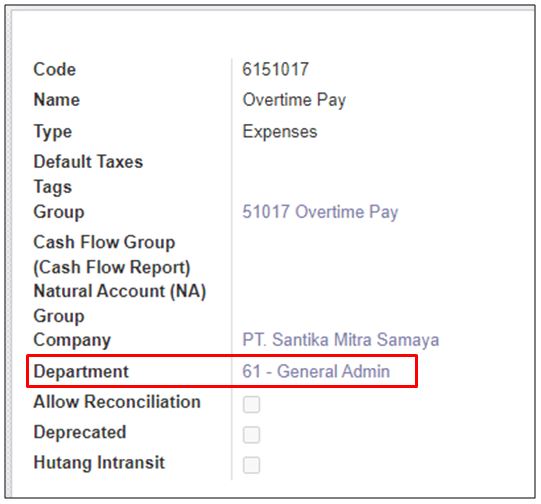

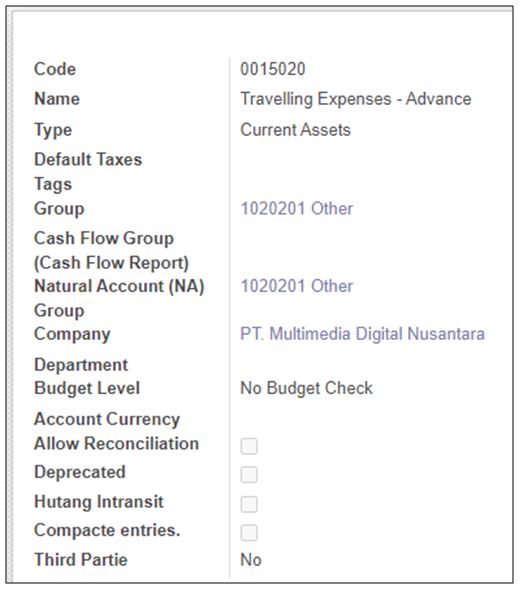

If using the original model of Chart of Accounts from Odoo, the implementation were not possible. But we implemented modifications to enable the COA structure in Odoo transactional by adding a field of Department with reference to model hr.department in model account.account.

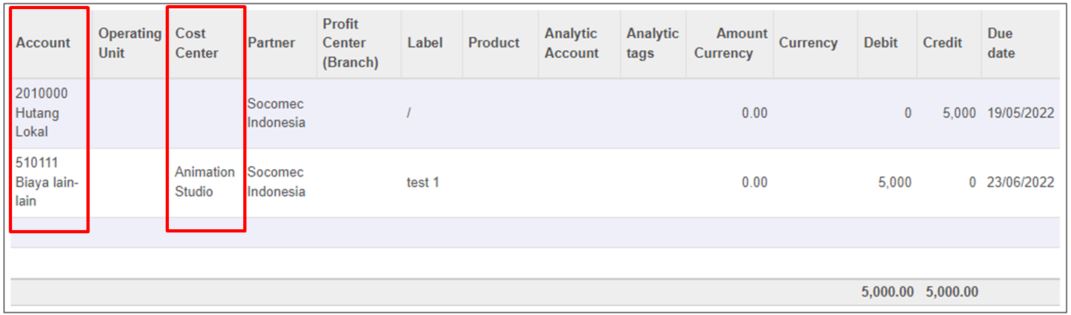

The example of chart of accounts usage in Hospitality Implementation in Journal Entry.

As display on picture above, the journal means, the transaction is specifically applied as department expense for department with code '61'. By using department in chart of accounts code, it means, for each natural account which applied for department, will have several rows of master chart of accounts.

ERP Implementation

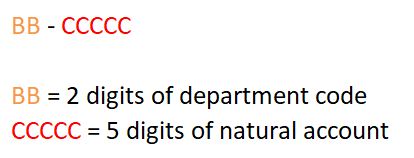

On the other side of Kompas Gramedia, there are several units which has been using another ERP system before migrating to Odoo. The chart of accounts used in ERP system were only consists of the natural account, while the department will become a financial dimension and the department will be written in journal entry transaction.

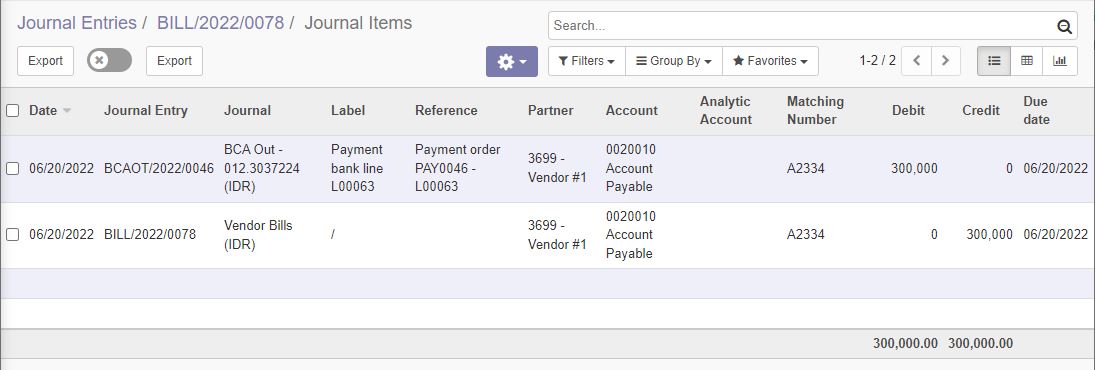

The example of chart of accounts usage in ERP Implementation in Journal Entry.

The additional financial dimensions added in ERP Implementations are:

- Operating Unit

- Profit Center (Branch)

- Cost Center (Department) - the same function as field department in Chart of Accounts master

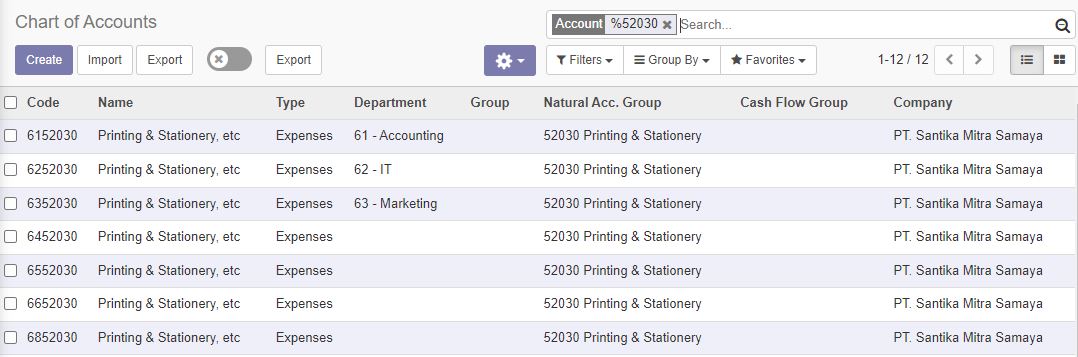

By using this structure of chart of accounts, the rows of data master chart of accounts will have less rows, since the natural account only have 1 row data and will be used by all department available in journal entry transactions.

Reconciliation

On screen master Chart of Accounts, there is a flag of Allow Reconciliation. If checked, the account will be enabled to reconciliation.

Chart of Accounts type which mandatory on "Allow Reconciliation":

- Receivable

- Payable

Chart of Accounts type which are not available for reconciliation:

- Bank and Cash

- Credit Card

Hutang Intransit

Hutang Intransit is an chart of account used in Kompas Gramedia implementation to record all purchase transaction which not created to vendor bill yet. The flag Hutang Intransit added to enable differentiate the hutang intransit account with another account for reporting purpose. The AP report mentioned was "Hutang Intransit Mutation".

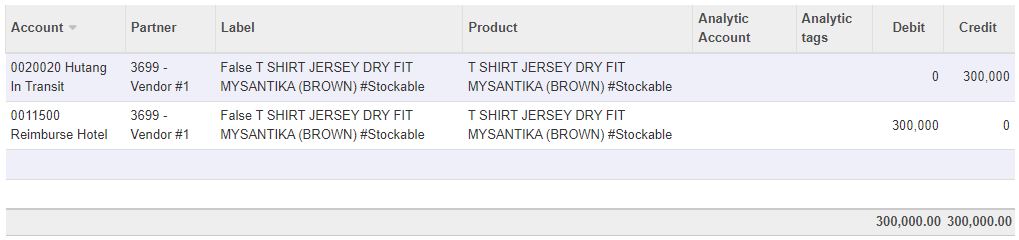

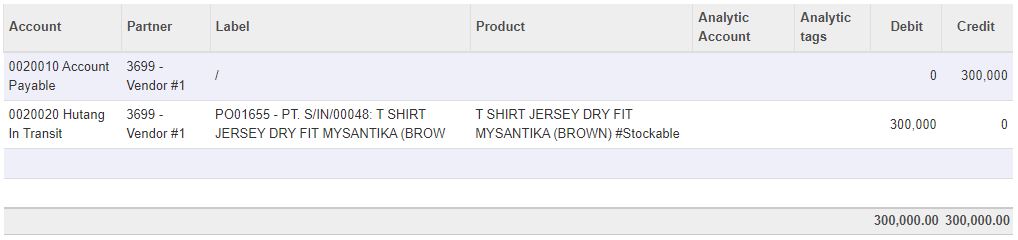

Here's the example of Hutang Intransit account usage in Purchase transactions.

After journal entry creation from Vendor Bill, Odoo will automatically reconciled both journal entries by add Matching Number.

Import Chart of Accounts

There are 2 ways of importing data chart of accounts to Odoo:

- Import Chart of Accounts from bought modules

- Import Chart of Accounts original function from Odoo

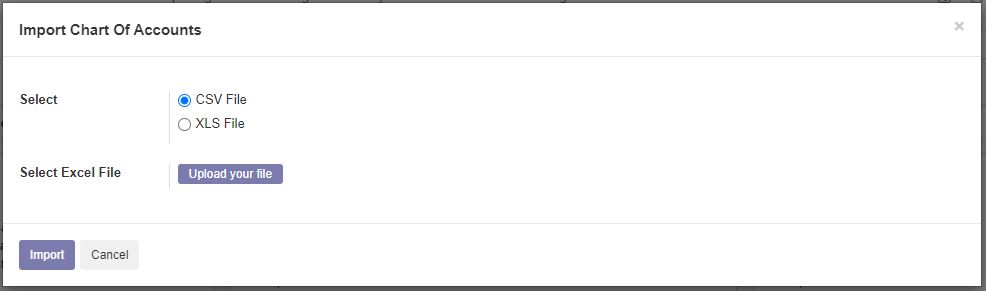

Import CoA using bought modules

Invoicing > Sales > Import Charts of Accounts

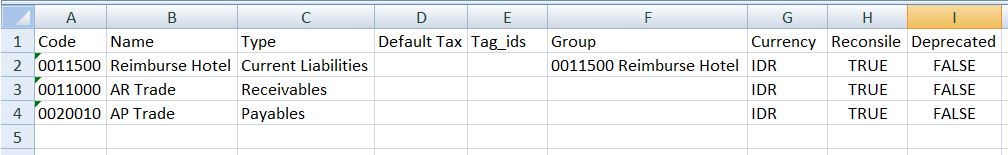

The template on upload chart of accounts using this function:

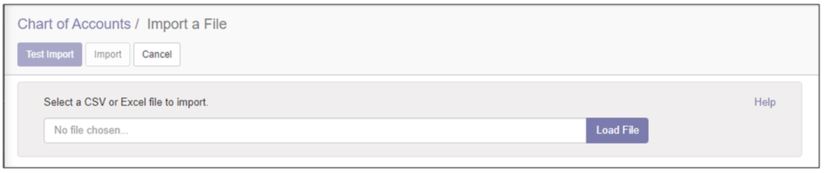

Import CoA using original Odoo function

Invoicing > Configuration > Chart of Accounts > Import

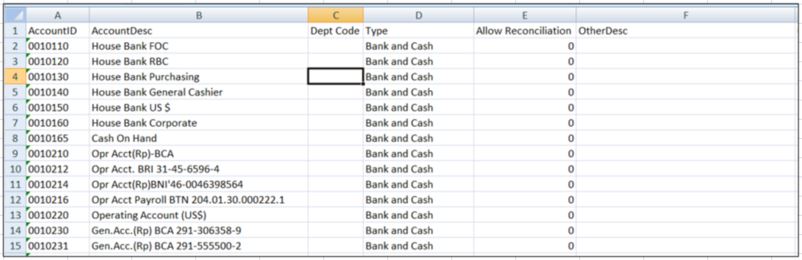

There are no specific file template in importing chart of accounts using this function. Example:

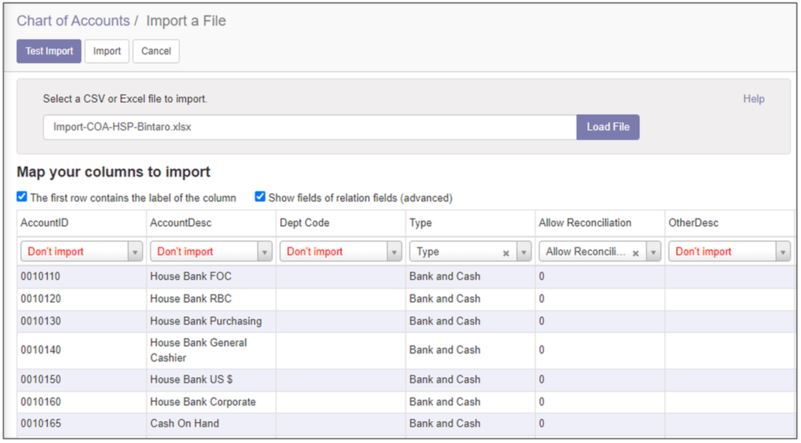

After prepare the data on excel file, click button [Load File] on screen.

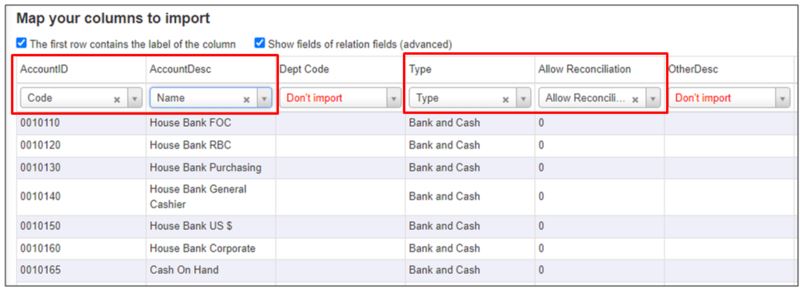

As displayed above, if the column name have the same name as the field available in Odoo, they are automatically mapped to Odoo's field. But some of the columns, need manual mapping.

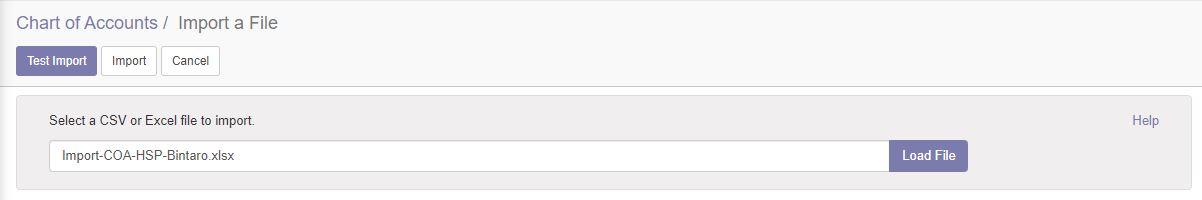

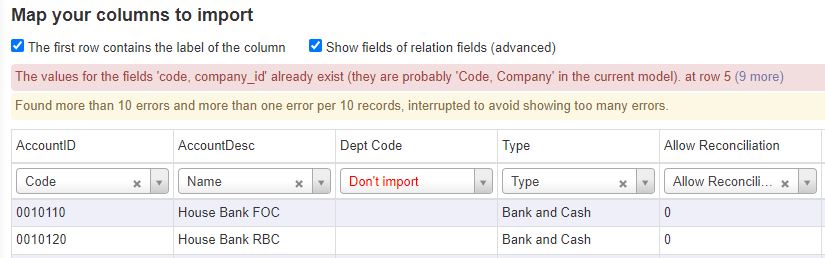

After finish with manual column mapping, click button [Test Import]. If there are (if any) errors, the error message will be displayed, and the import process will be failed until the error fixed.

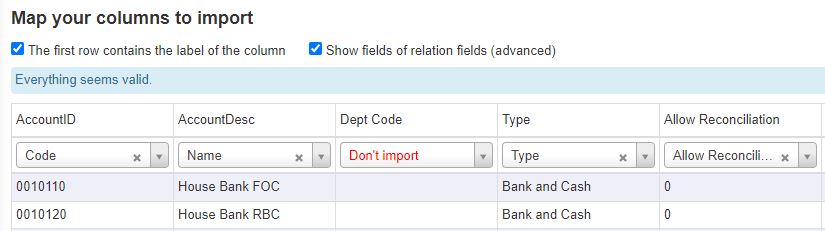

If there are no error message displayed after click button [Test Import], then continue with click button [Import].