Tax Configuration

Description

Additional Notes

In hospitality implementation the field of VAT from table or model res.company will be displayed with label TIN (Tax Identification Number). In ERP implementation, field of VAT from table or model res.company will be displayed with label VAT (Value Added Tax). Both implementations are using the same field from model res.company but using different label on screen.

PPN (Pajak Pertambahan Nilai)

PPh (Pajak Penghasilan)

Customer Invoice

There are several ways to include tax of PPh in Customer Invoice:

PPh as Withholding Tax

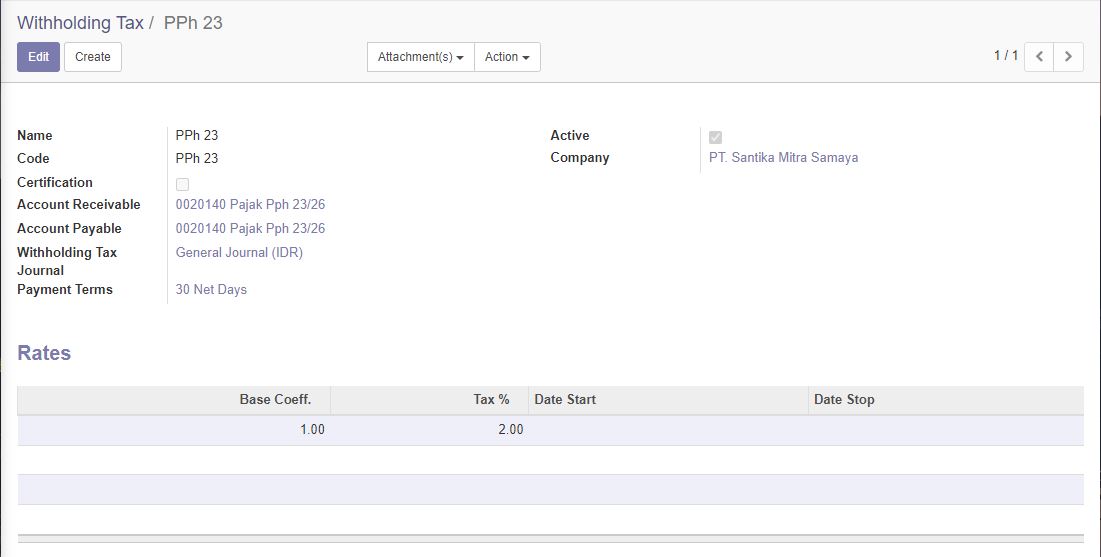

To input PPh value as witholding tax, please create a withholding tax master first. Invoicing > Configuration > Withholding Tax. For in details user guide on how to create master witholding tax, go to Withholding Tax section.

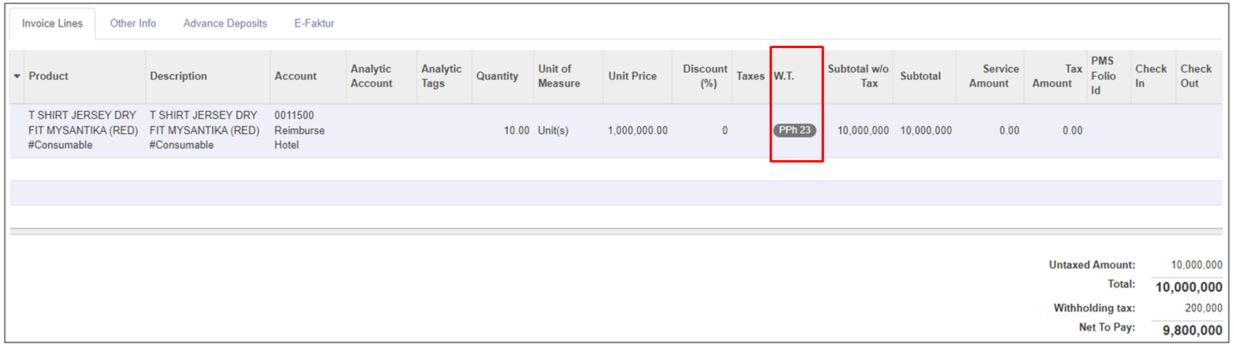

On process input invoice, select the withholding tax in column W.T.

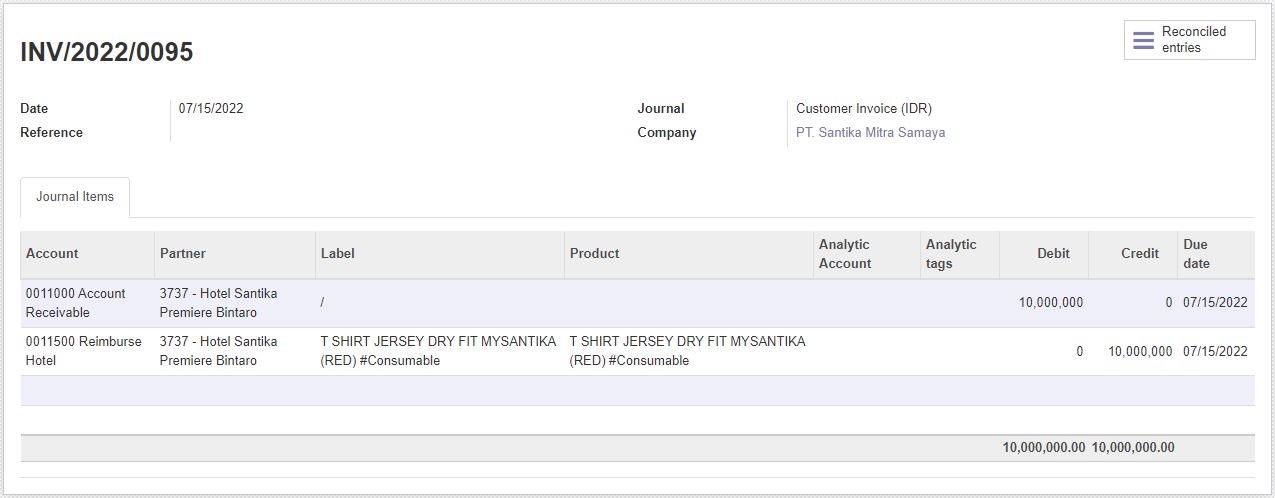

After Customer Invoice validated, the journal entry created:

As picture shown above, the withholding tax not written yet on journal entry. The journal for withholding tax will be written on event invoice payment.

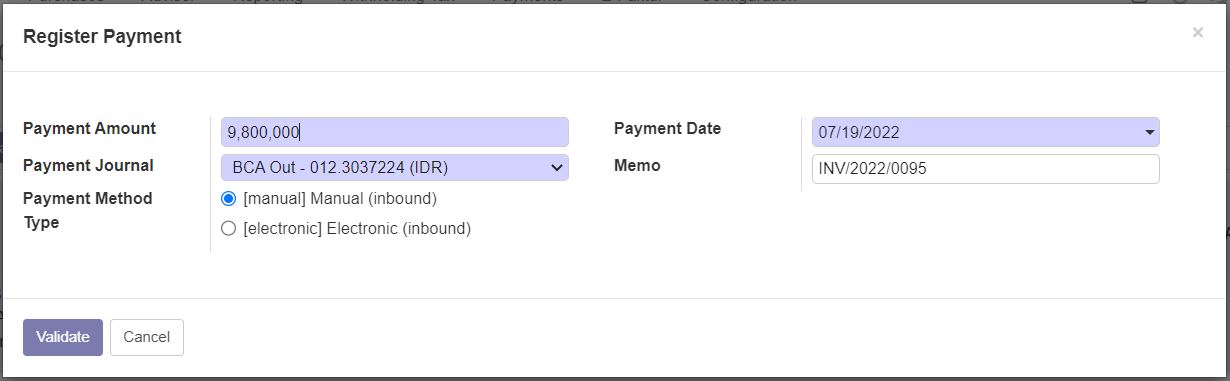

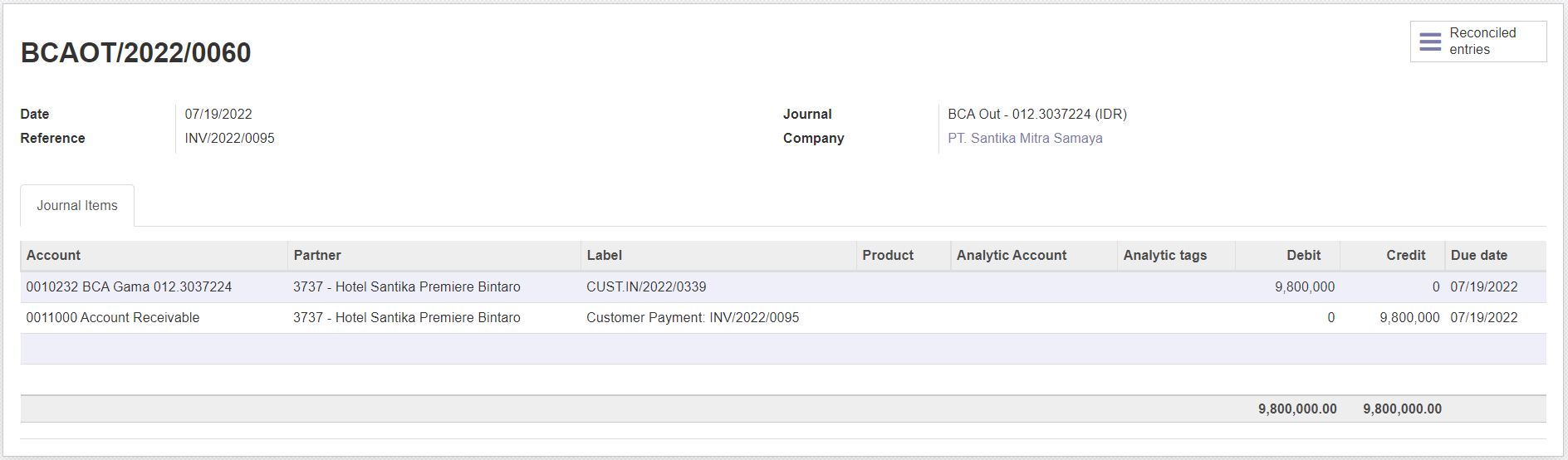

After payment validation and payment approval, here is how the journal of money received created in Odoo:

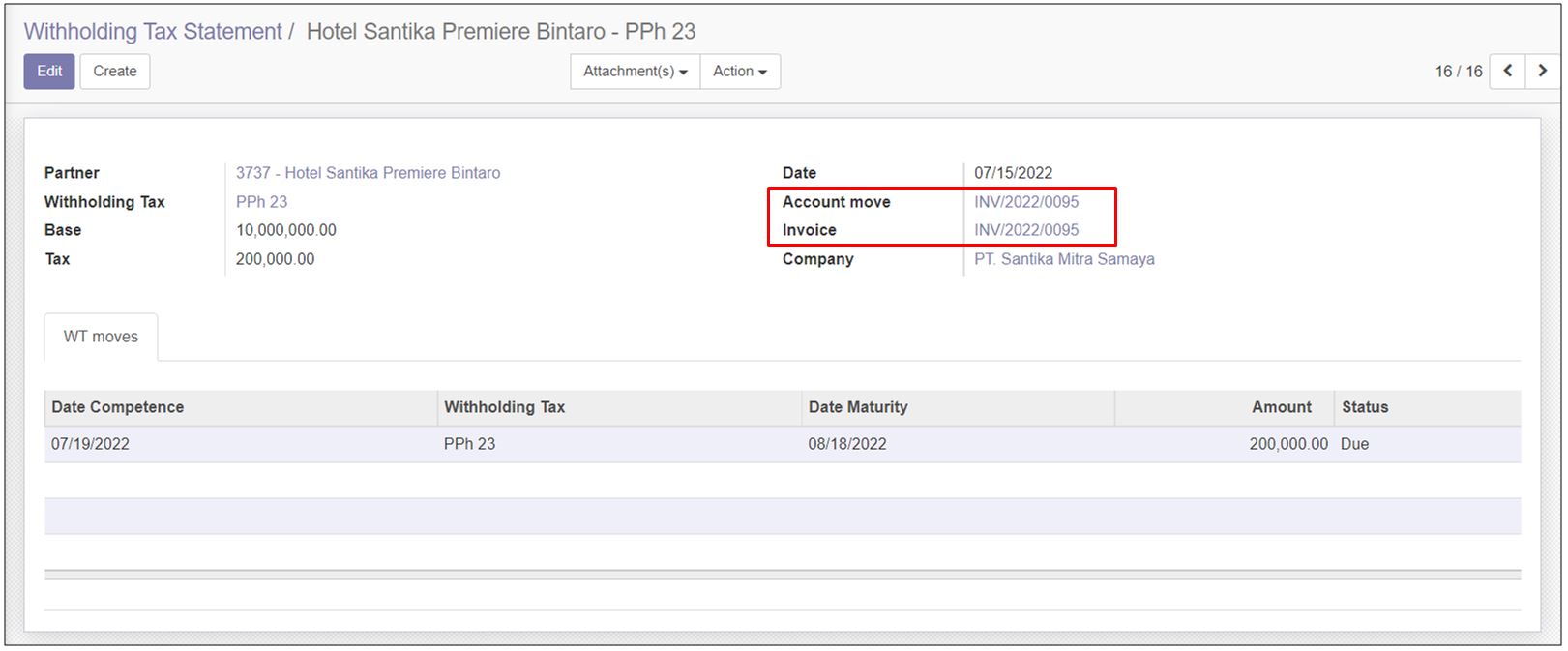

The withholding tax will not be written to journal unless we paid the withholding tax. Here is the withholding tax statement. Make sure to match the Invoice number in withholding tax statement with the current invoice/journal number.

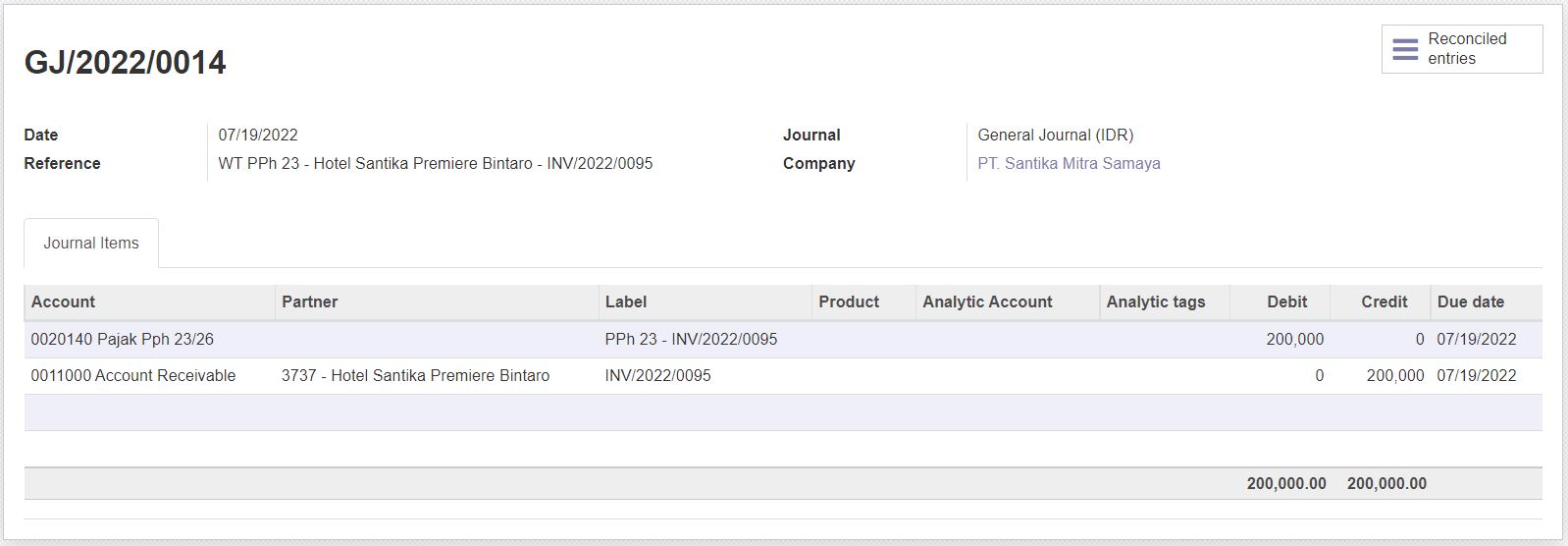

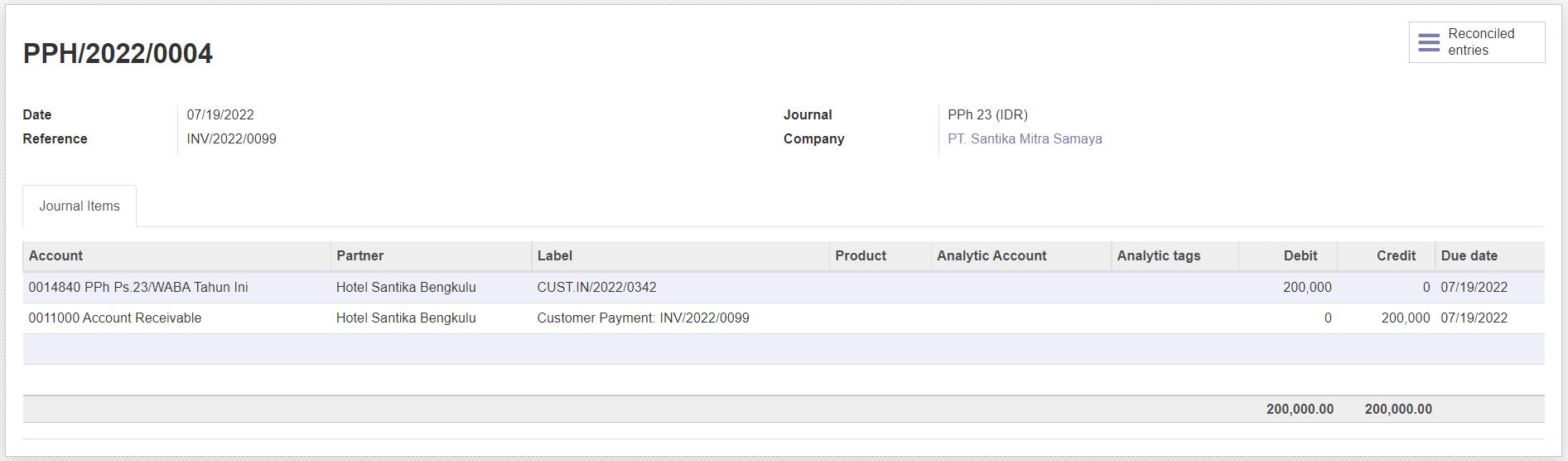

For detailed on withholding tax, go to Withholding Tax section. After withholding tax payment, here is the journal created on withholding tax payment.

For recap, if the PPh declared as withholding tax, the journal PPh to AR will be written on event payment. The payment event not automatically write journal PPh to AR, but could be done later or before the payment receive from Customer.

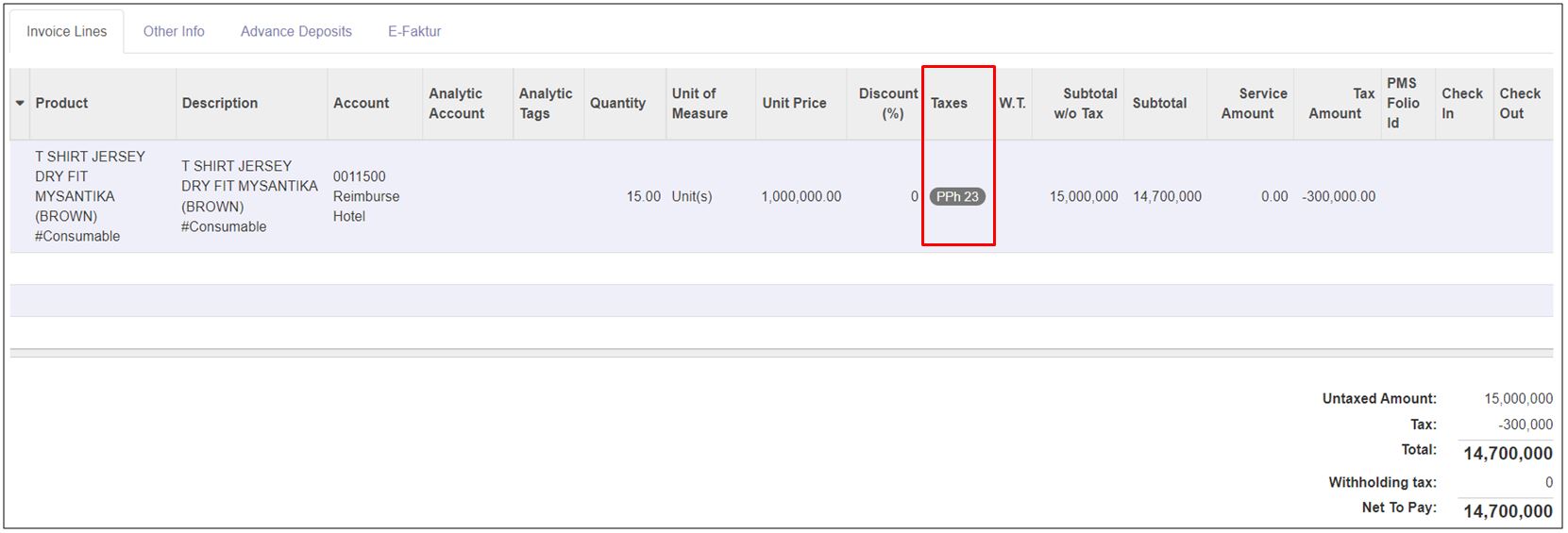

PPh as Taxes

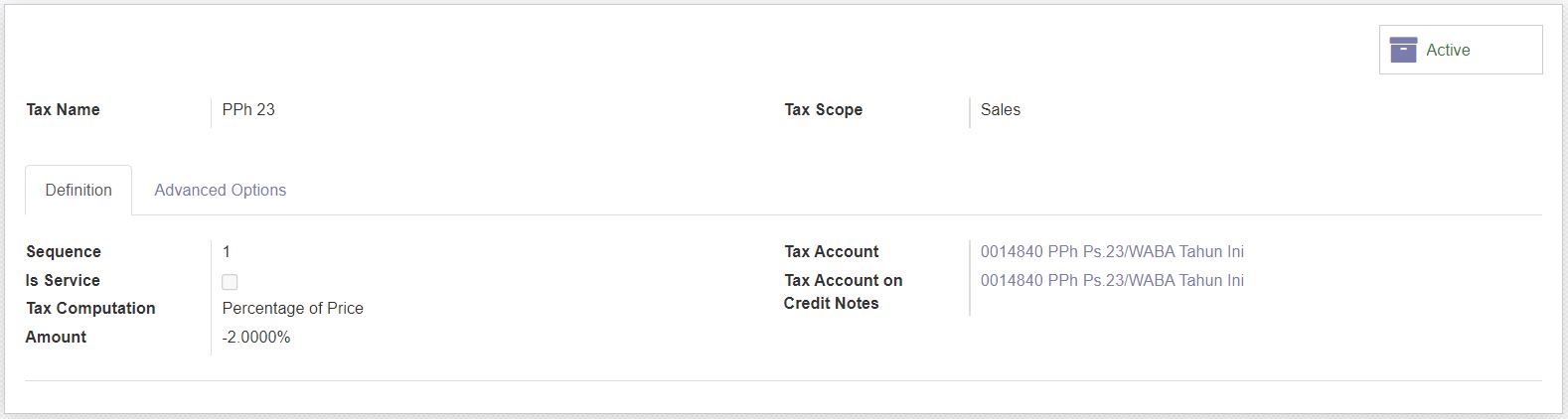

To input PPh value as taxes, please create a tax master first. Invoicing > Configuration > Taxes.

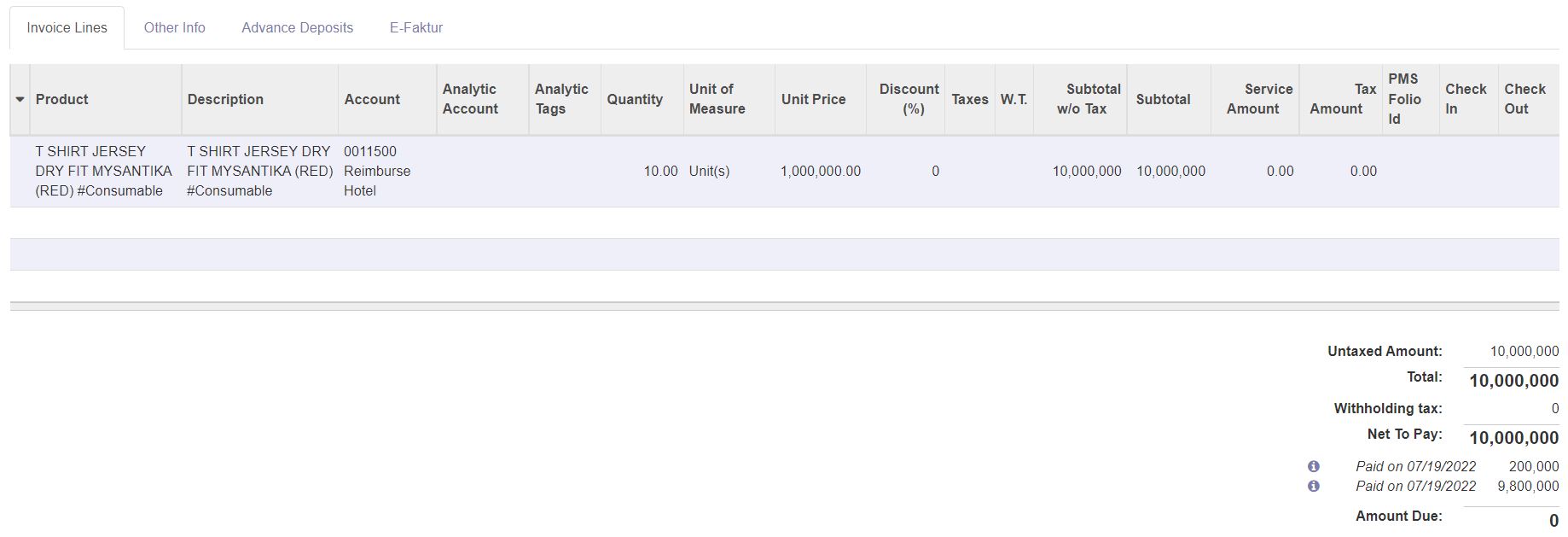

As displayed on picture above, the amount written as negative, because the PPh reduce the amount receive/customer payment. Here is how the input process in Customer Invoice:

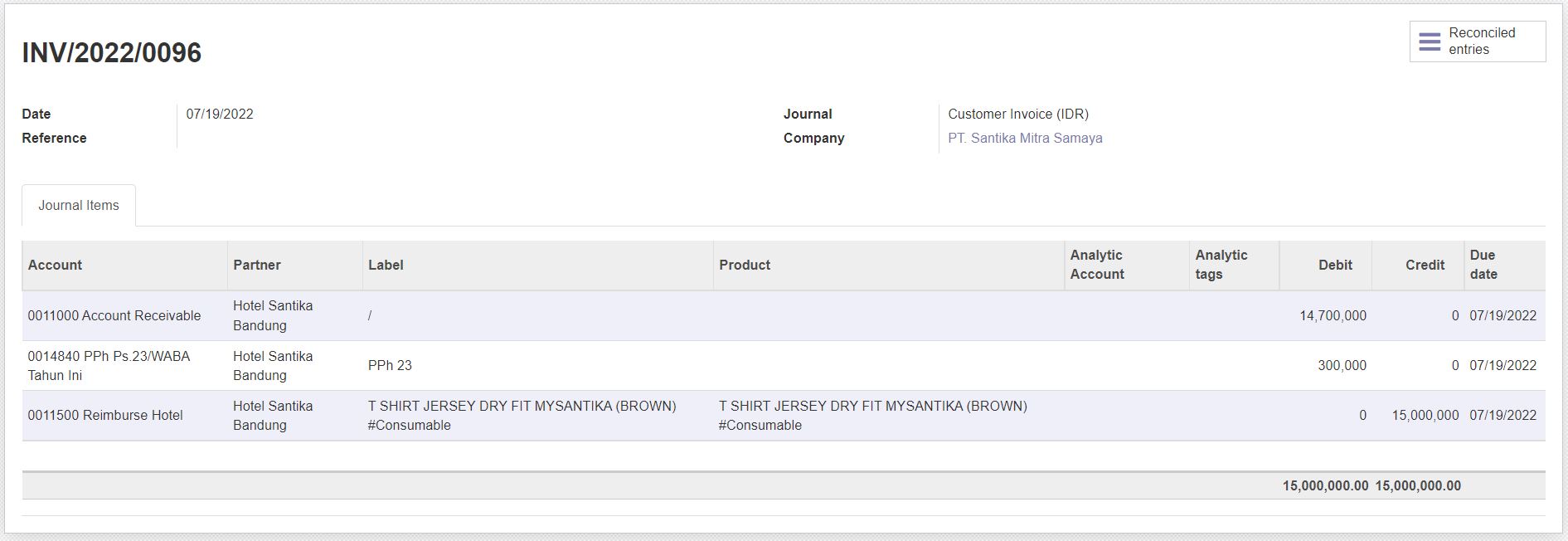

After Customer Invoice validated, the journal entry created:

As displayed on picture above, the customer net to pay will automatically reduced and we only need to register payment received based on customer net to pay.

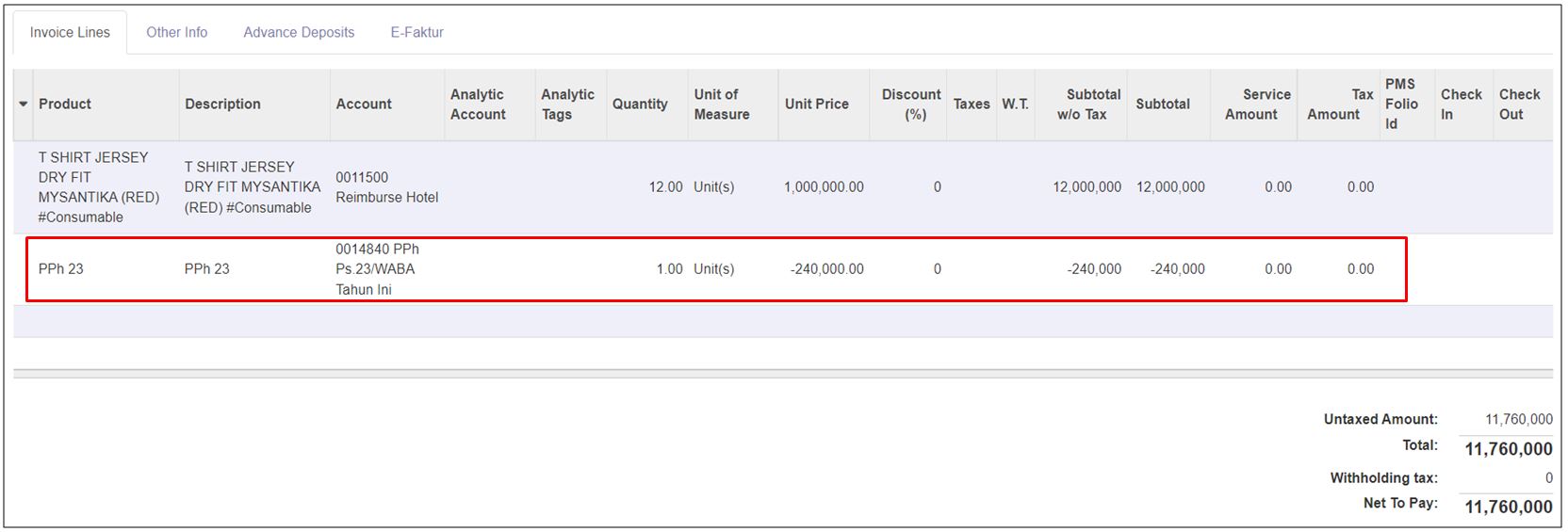

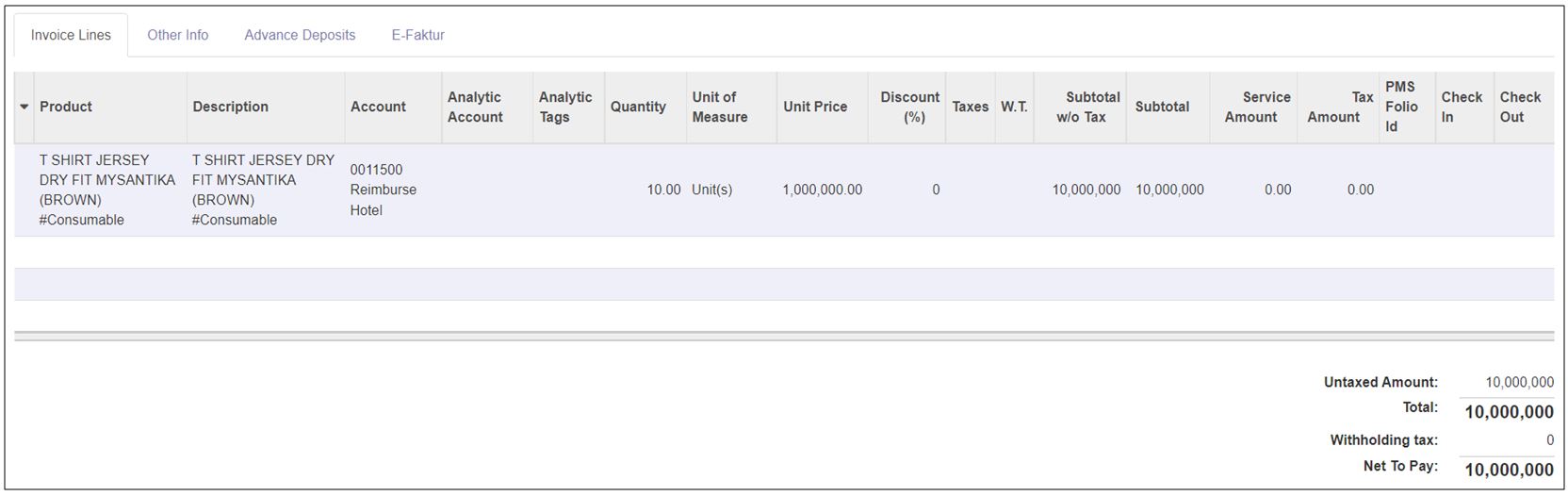

PPh as additional items in Customer Invoice

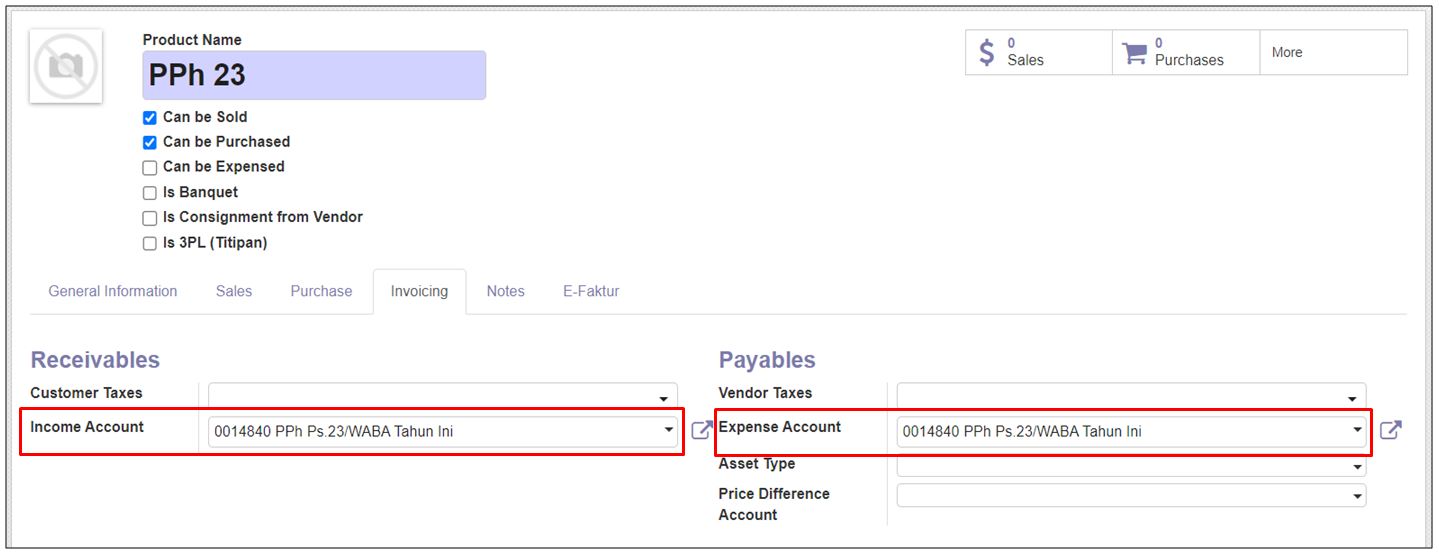

For PPh input process as additional items, the journal result will be the same as PPh as Taxes. Here is the step by step on input PPh as additional items in Customer Invoice. Please make sure the PPh as product is already created. Inventory > Master Data > Product.

The product should be created as Consumable or Service and the account setting directly to the Income Account and Expense Account. On create invoice, add the PPh product as additional item in Customer Invoice.

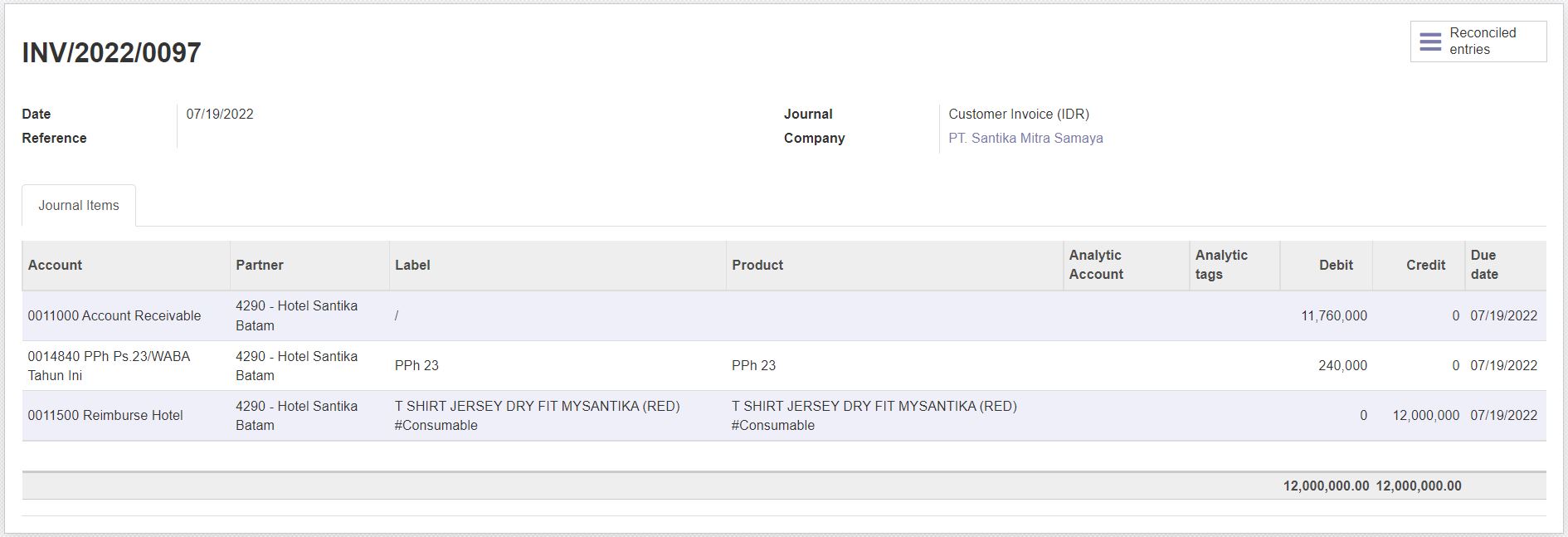

After Customer Invoice validated, the journal entry created:

The cons on using this method to record PPh amount is the user have to calculate the amount PPh manually. The user input and user manual calculation means higher risk of human error.

PPh as additional payment in Customer Invoice

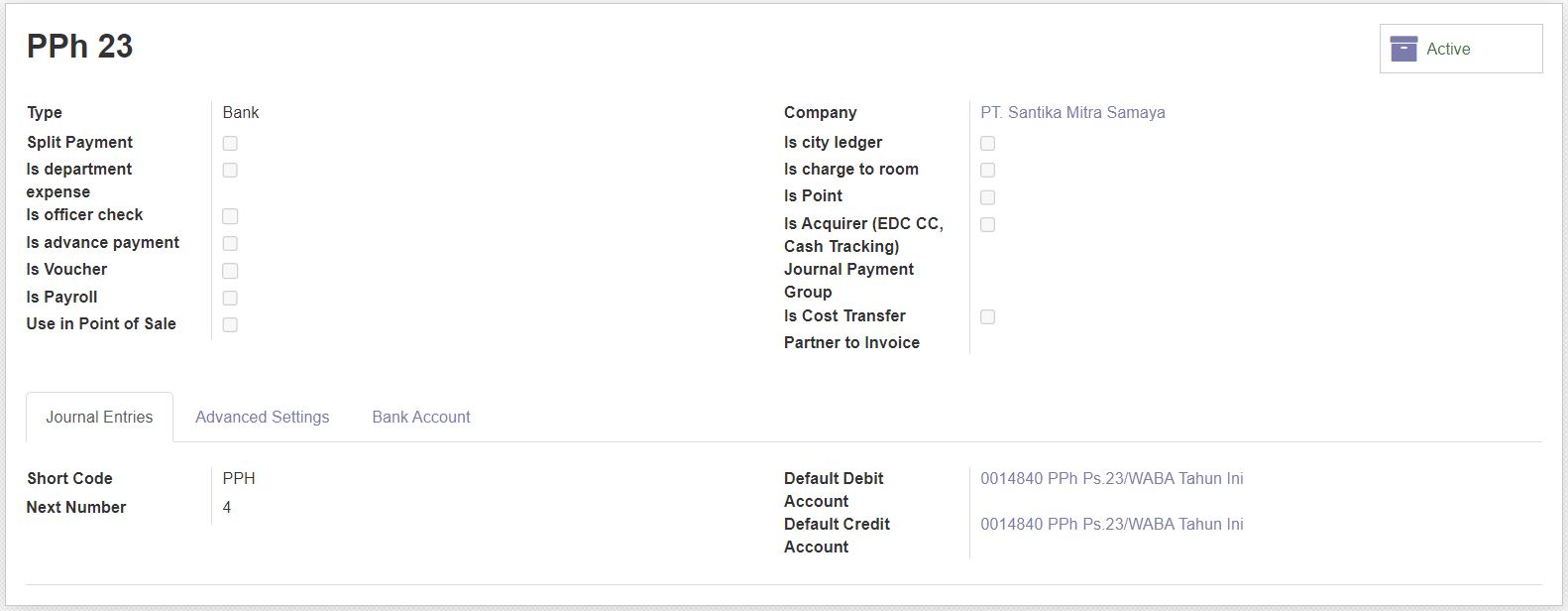

This is another way of record PPh payment in Customer Invoice. The prerequisite in using this step is to create journal PPh with type Cash/Bank specifically to write PPh as payment.

This process will resulting the same journal entry with using PPh as withholding tax. On process input Customer Invoice, do not input any tax or withholding tax information on Customer Invoice.

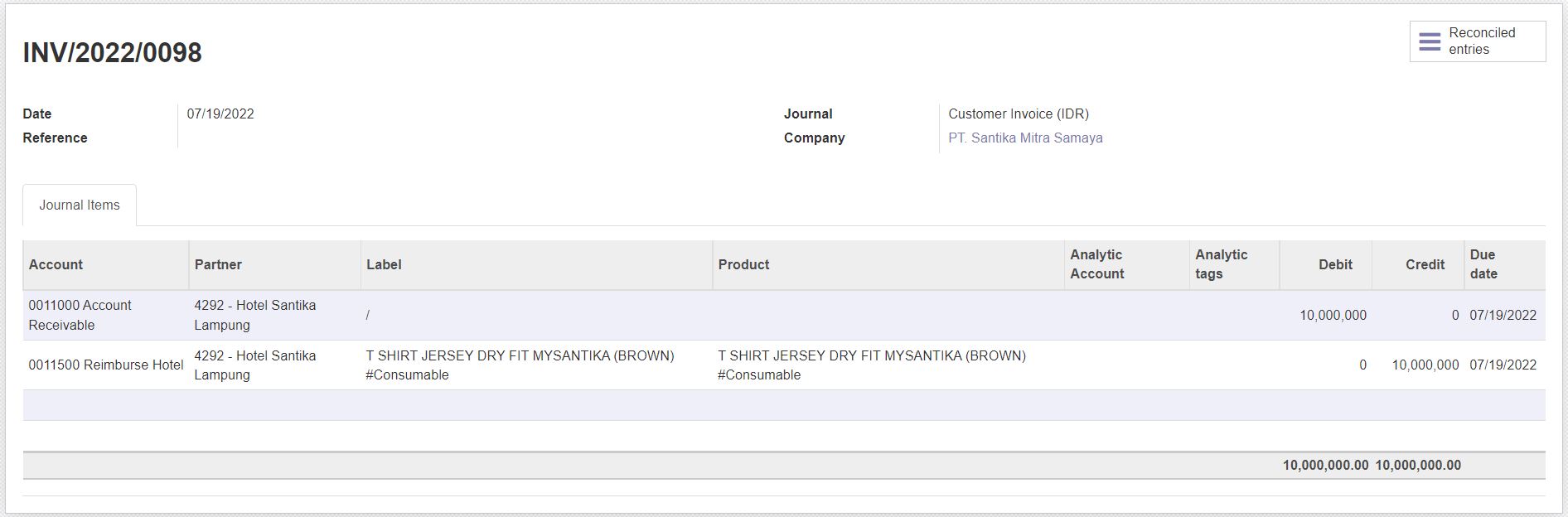

After Customer Invoice validated, the journal entry created:

The applicable case on this way of PPh registration is when the Customer include "Bukti Potong" to reduce payment. It means, the tax has been paid by Customer. There are 2 case receiving payment and bukti potong:

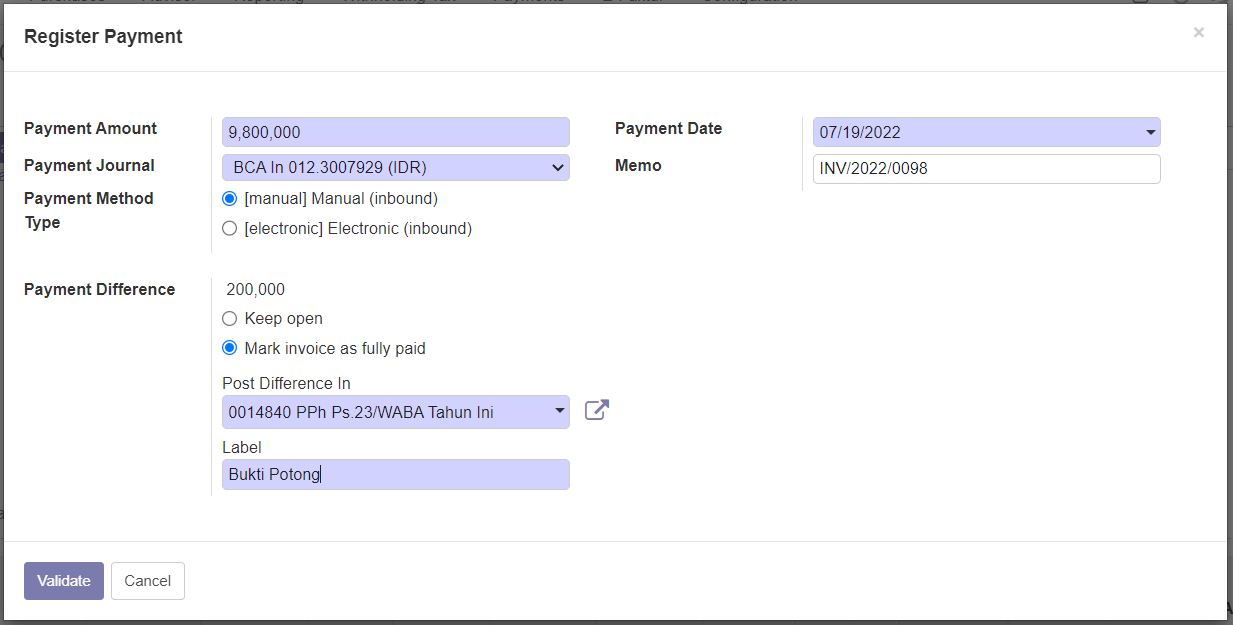

- If the payment received and bukti potong PPh received and registered at the same time

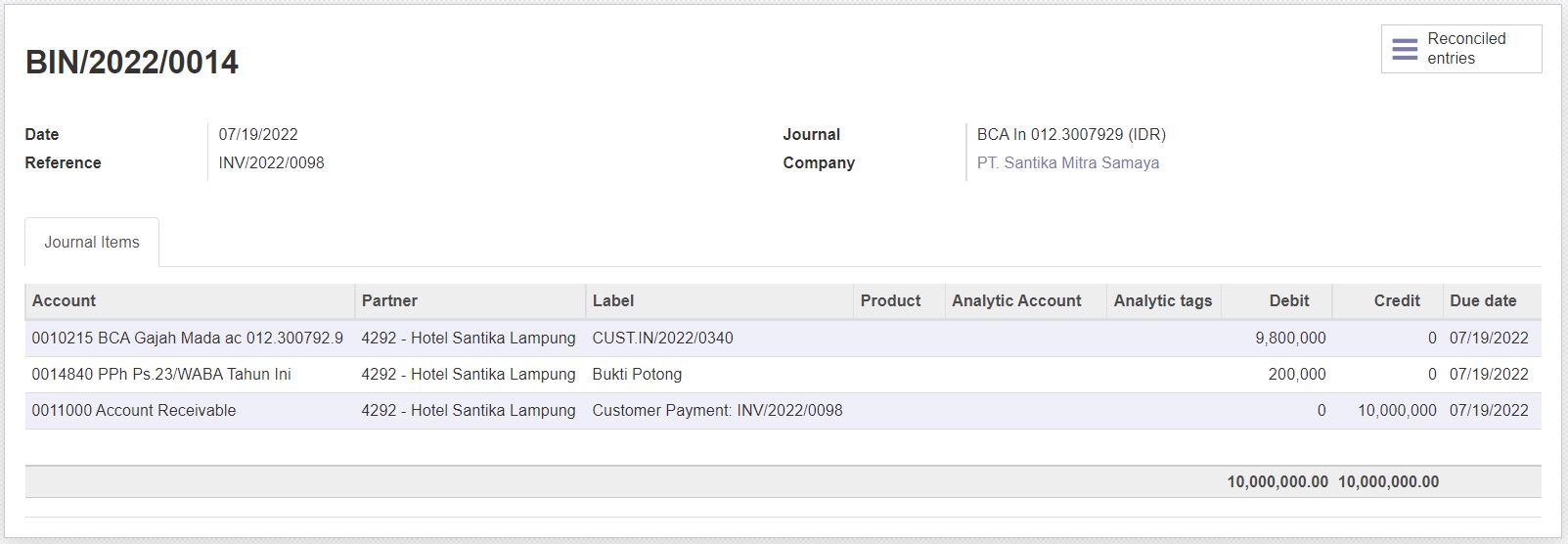

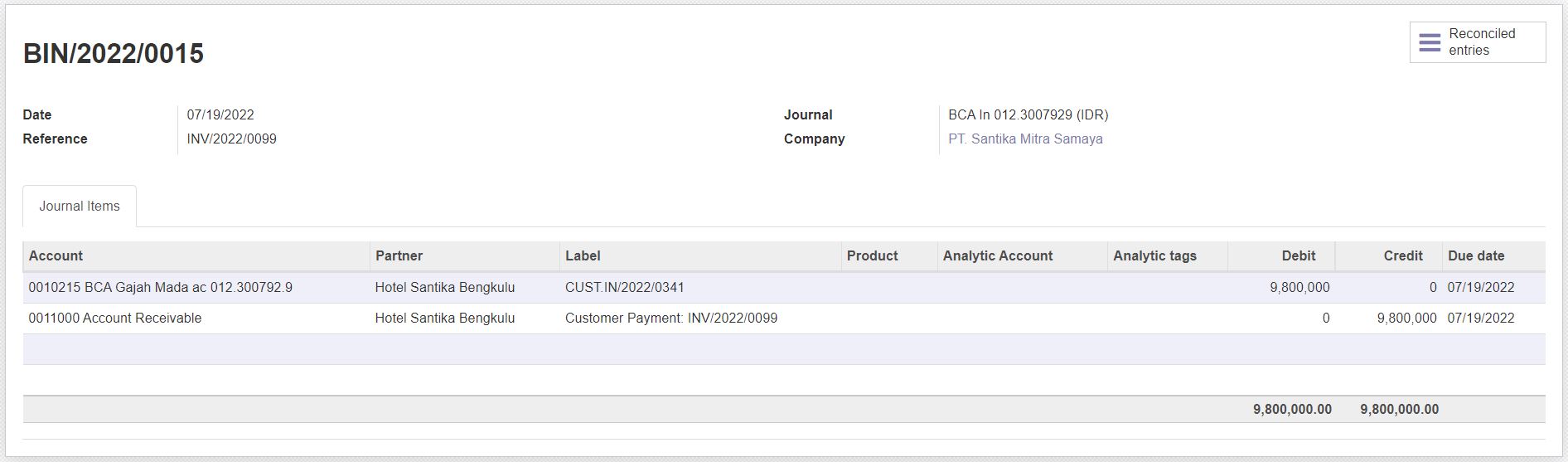

The journal entry created on payment after payment approval is:

- If the payment received and bukti potong PPh received and registered on different time

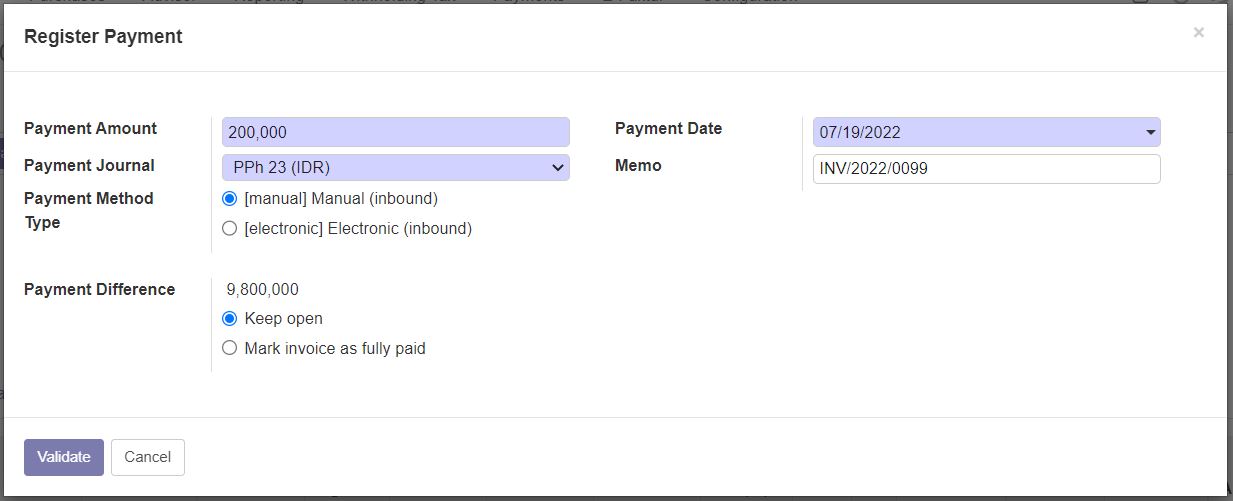

If the bukti potong received first, then input partial payment registration on invoice. Input the amount of bukti potong, then keep invoice status as open.

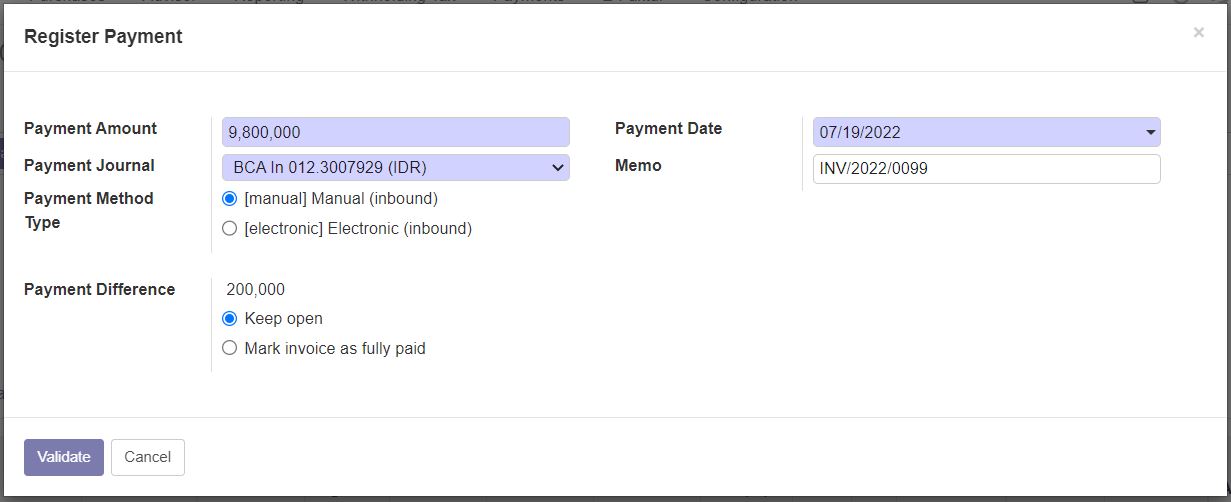

If the payment from Customer received first, then input partial payment registration on invoice, keep invoice status as open.

The invoice will record the payment as 2 different payments and could be done at 2 different days.

Here is the journal entry for cash/bank payment received:

Here is the journal entry for bukti potong PPh received:

Vendor Bill

PPh as Withholding Tax

PPh as Taxes

PPh as additional items in Vendor Bill

PPh as additional payment in Vendor Bill

Modification Request

ERP Implementation

- On fill or change field VAT or TIN in partner (customer or vendor), the system should update both field because each field is used in different purposes.