User Guide

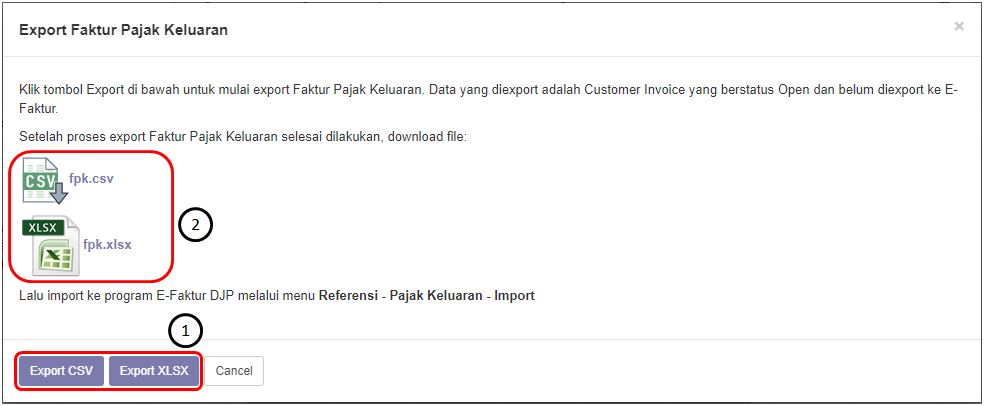

Export Faktur Pajak Keluaran

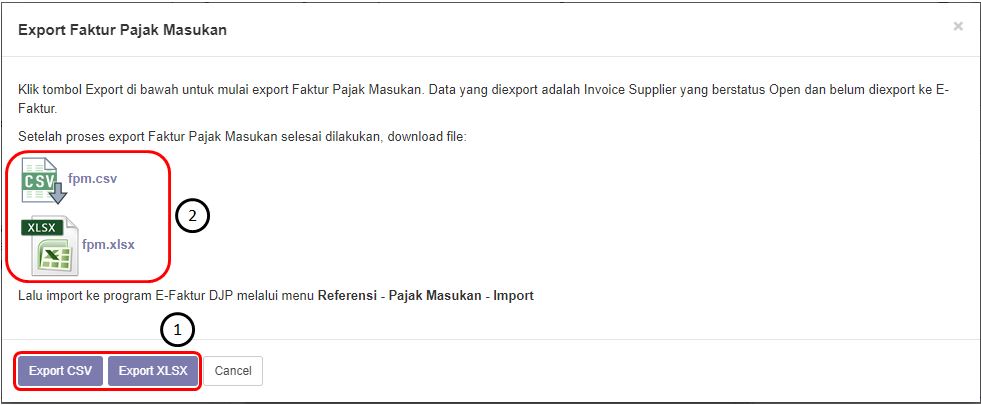

Export Faktur Pajak Masukan

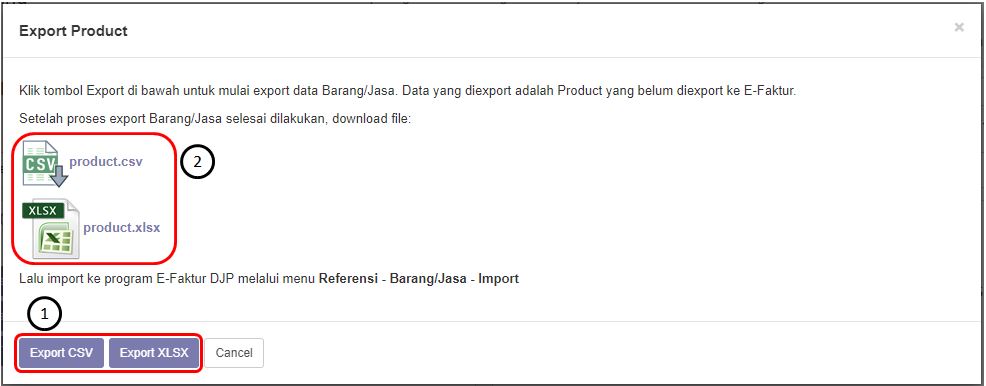

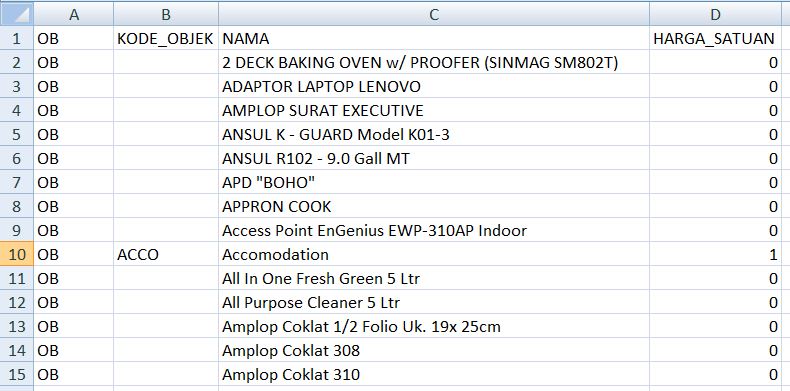

Export Products

Steps on export product list to upload/import data directly into efaktur:

- Invoicing > E-Faktur > Export Products

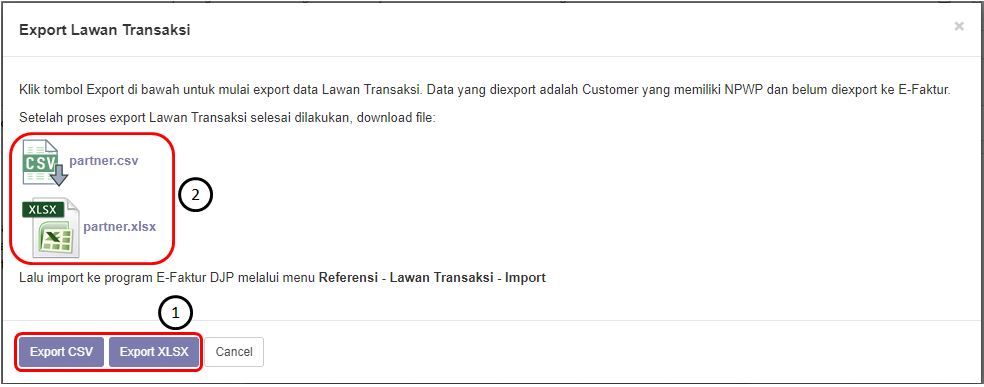

- Click the button of [Export CSV] if the target format file is CSV and click button [Export XLSX] if the target format file is xlsx.

- Click the csv icon or the xlsx icon to download the file.

Export Partner

Generate Nomor Seri Faktur Pajak

Dalam membuat Customer Invoice, terdapat di modul Invoicing E-Faktur Generate Nomor Seri Faktur Pajak.

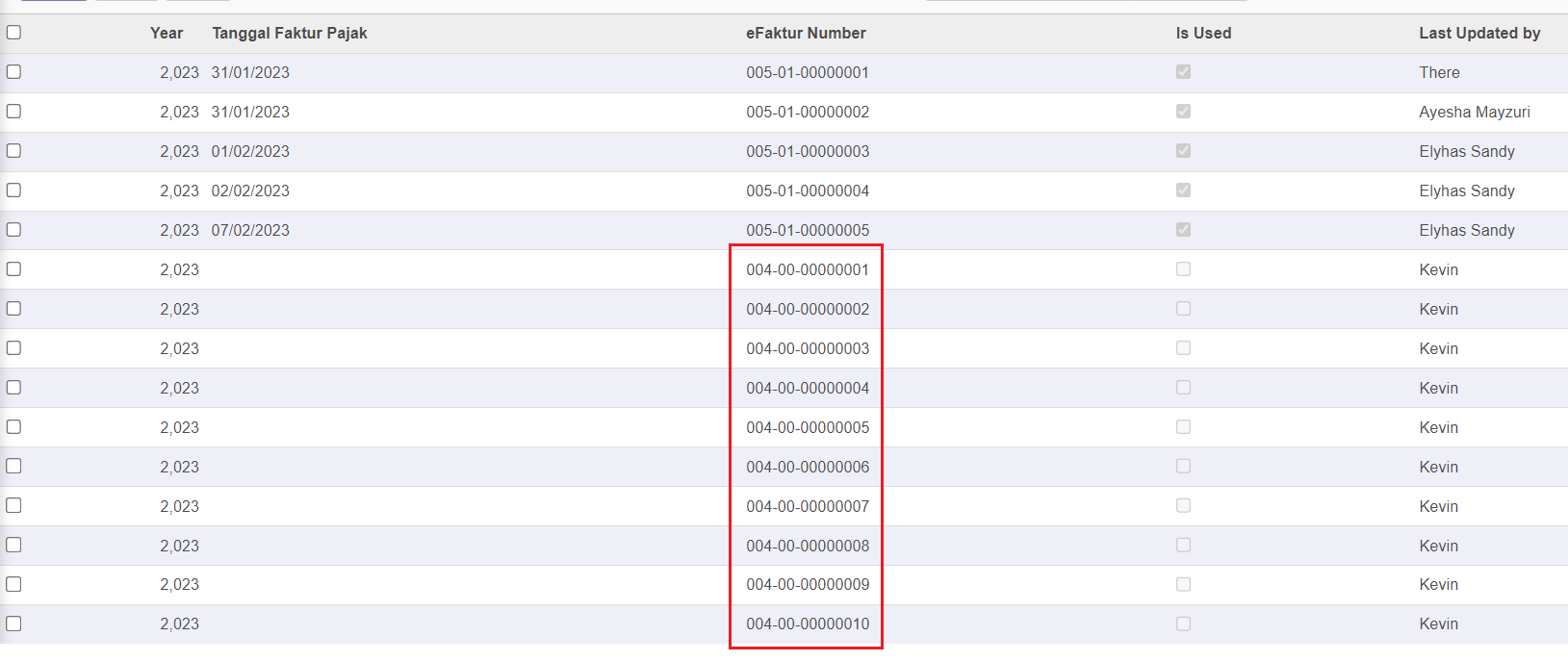

Creating a serial number for a Tax eFaktur aims to create a serial number automatically based on the range of tax invoices determined by djp for a certain year. eFaktur number will be generated automatically based on Start and End fields.

Generate from 00001 at start and 00010 at end. This means that it will generate as many as 10 eFaktur numbers.

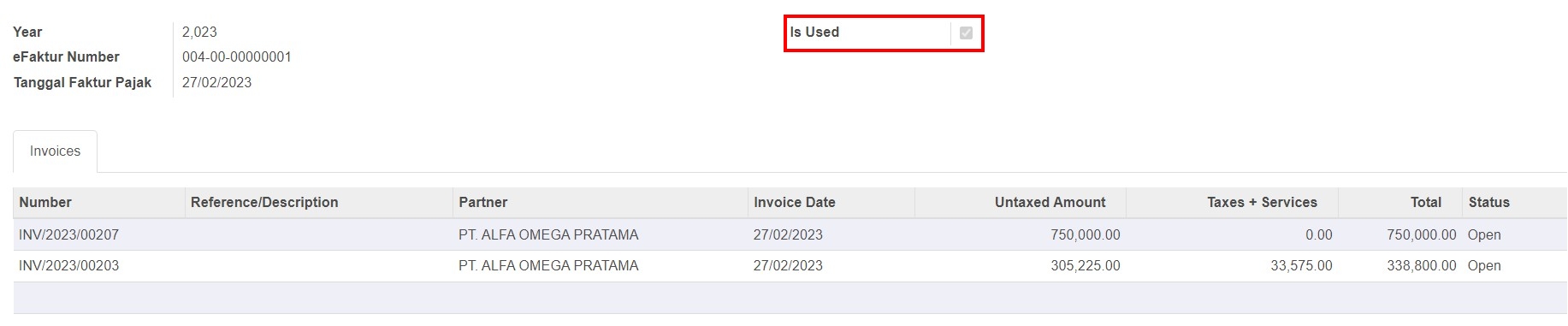

eFaktur number will be generated based on the distance previously determined. Each eFaktur number contains a Is Used Checkbox which will indicate that the eFaktur number has or has not been used in making an invoice.

Auto Numbering

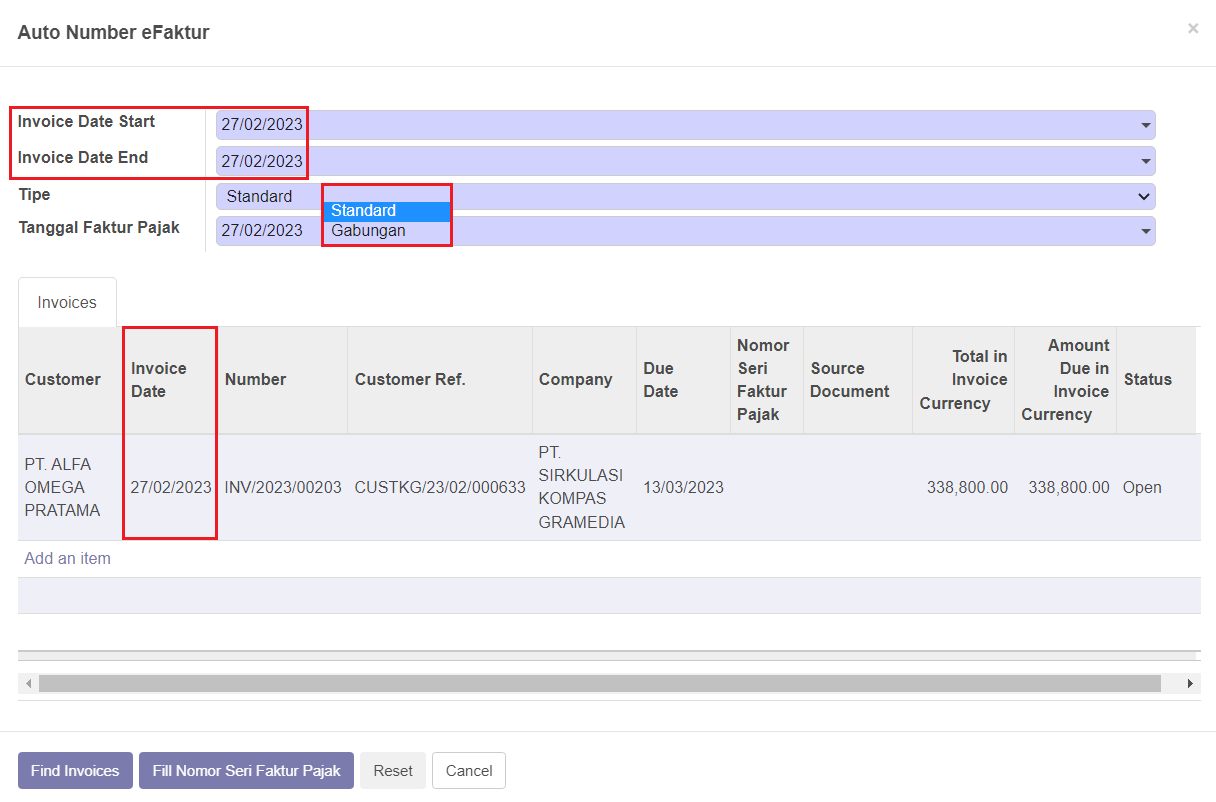

Filter in apply eFaktur number to display Invoices with a certain date range between Invoice Date Start and Invoice Date End.

The type will represent the eFaktur numbering on the invoice which is divided into 2 types, Standart which applies the eFaktur number on each Invoice Line with a different eFaktur number if there are 2 Invoice Lines and Gabungan which will apply the eFaktur number on all invoices Line with the same 1 eFaktur number (1 eFaktur number for several invoices).

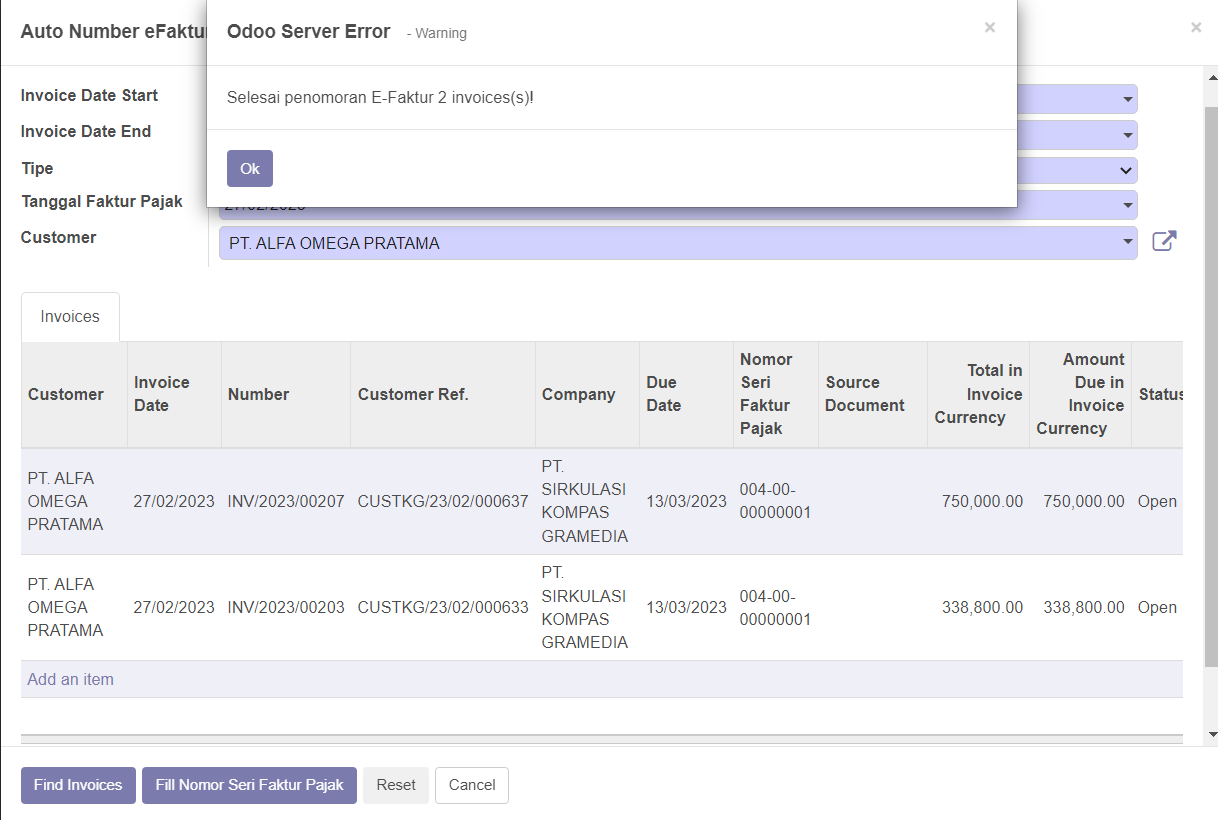

In case when doing add numbering with 2 invoice lines that are different from the Gabungan eFaktur add numbering type, all invoice lines will have the same 1 eFaktur number.

Therefore, the eFaktur Number will display all invoice lines that use the same eFaktur number. and Is Used checkbox will be filled.

Export eFaktur Invoice

Doing an export of invoice documents that already have an e-Faktur number is intended to do documentation and report to the DGT regarding the e-Faktur number that has been used in the invoice.

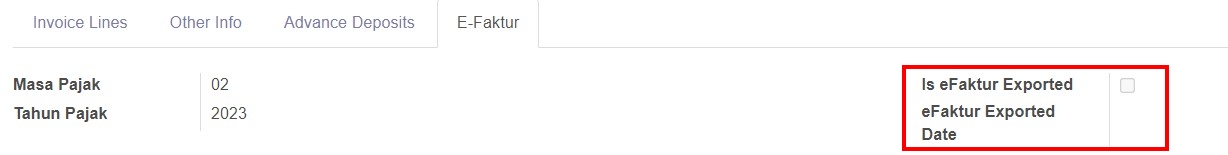

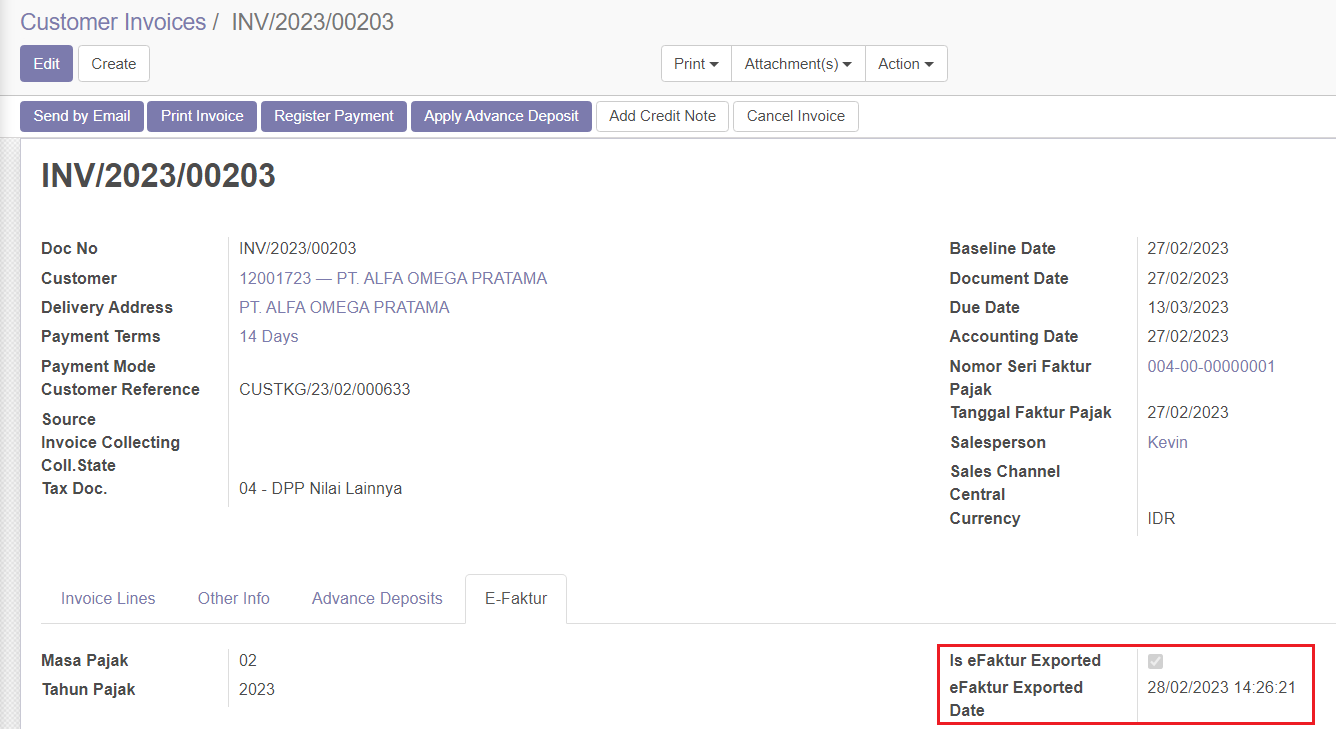

On related invoices, in the E-Faktur menu the user can see whether the eFaktur on the invoice has been exported or not. The checkboxes on eFaktur Exported and eFaktur Exported Date have not been filled.

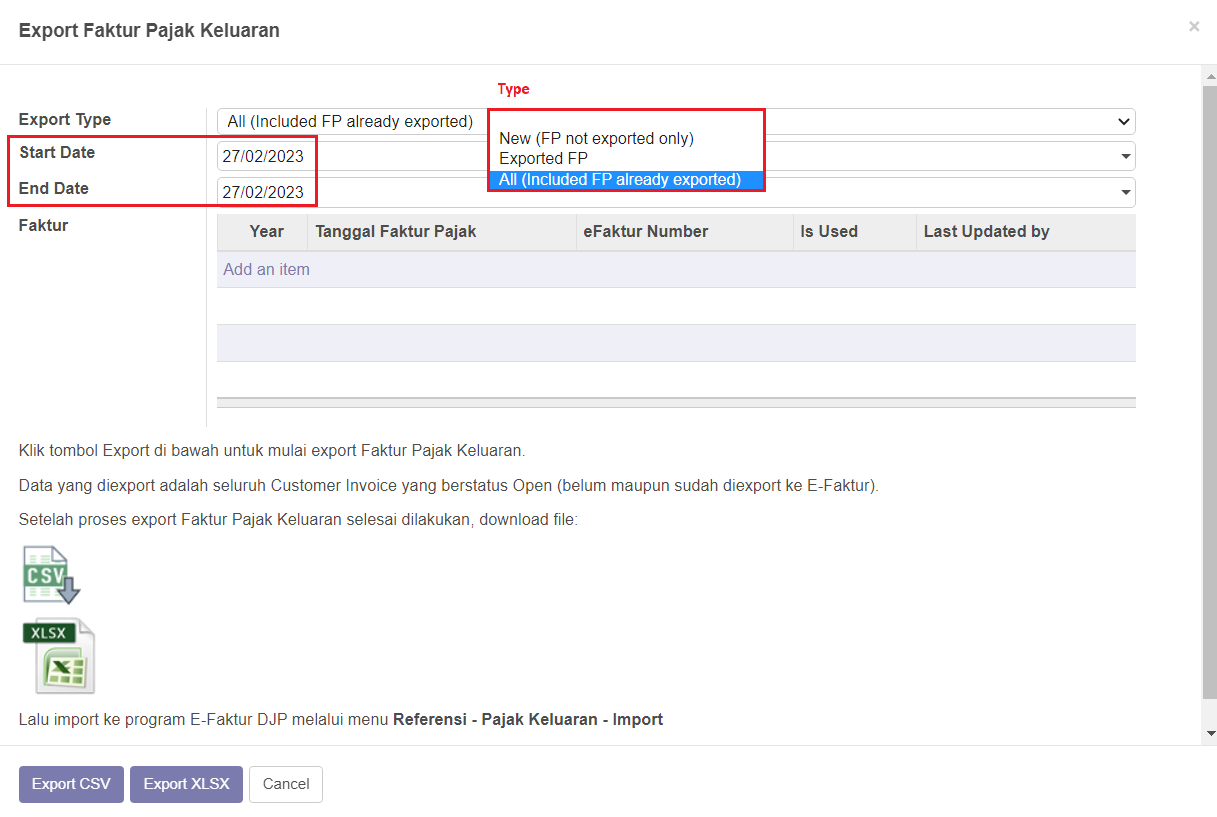

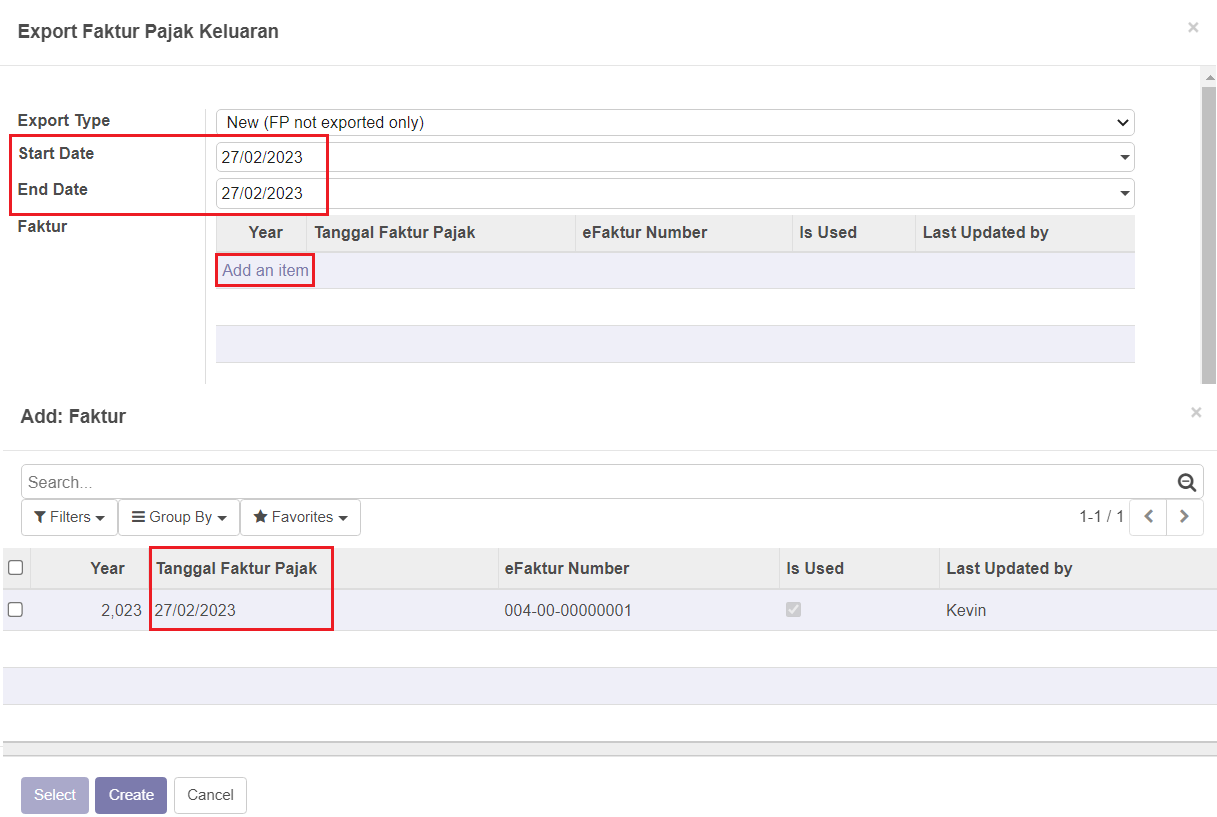

In exporting tax invoices there are several types for exporting, New (FP not exported only) will export tax invoices with the checkbox status not yet filled and will be displayed. Exported FP will only display a tax invoice with the status of the checkbox that has been filled in and the date export has been filled in, but when you export the invoice, the date export will be updated automatically based on the date the user exported the invoice for the last time. All (Included FP already exported) will display all types of invoices, whether they have been exported or not.

Export CSV Export Excel

To export invoice documents there are 2 options for output files in CSV or XLSX format.

When an invoice that already has an eFaktur number is exported, the checkbox status Is eFaktur Exported and eFaktur Exported Date on the invoice will be filled.

And when a user exports the same invoice at different times, the Exported Date invoice will be updated automatically based on the last time the user exported.