Create Customer Invoice

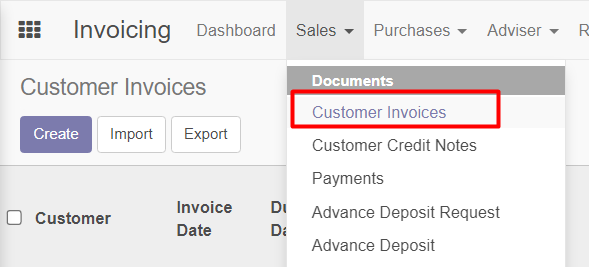

In making a Customer Invoice, it's in the module Invoicing Sales Menu (Documents) Customer Invoice.

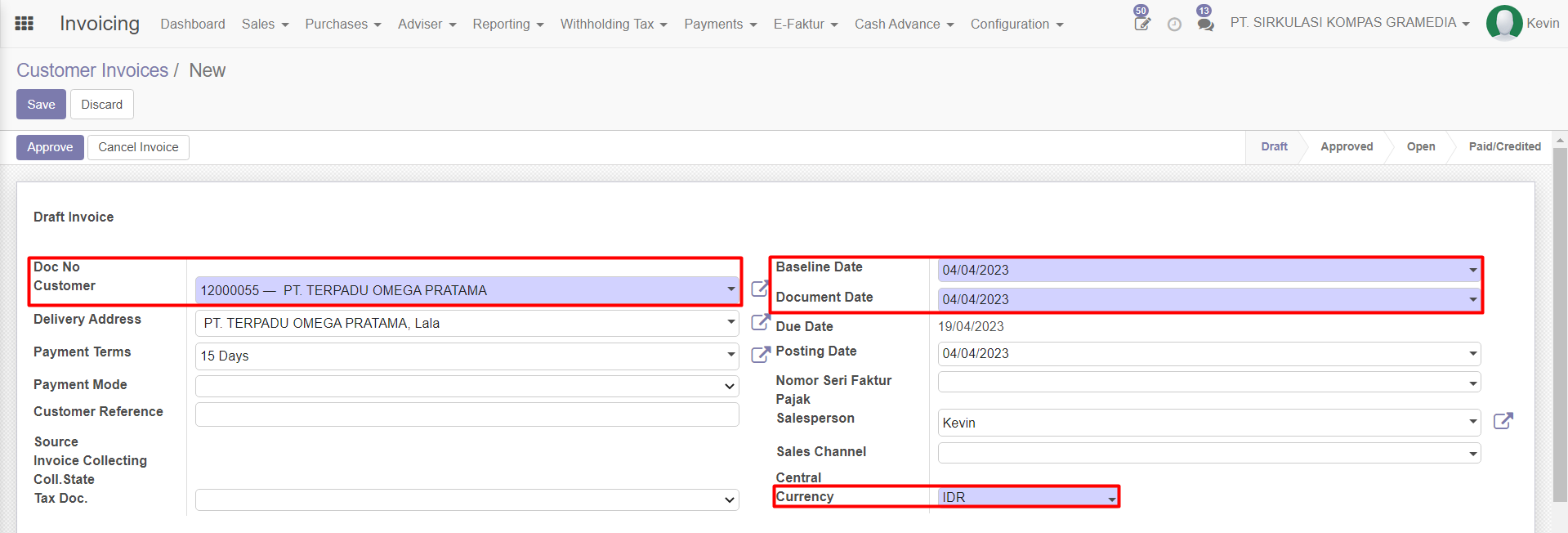

Making a Customer Invoice starts with inputting the mandatory fields that must be inputted by the user which contains basic information about the Invoice. The red boxes are some of the mandatory fields that must be inputted.

Customer Customers who are intended for making invoices, by inputting customers, then Delivery Address will be automatically generated based on the customer's warehouse location. Payment Terms will also be generated automatically, because basically the default time for payment is 15 days. With the generated Payment Terms, Due Date will automatically calculate the payment end date added from the invoice creation date.

Baseline Date

Document Date It will be generated automatically based on the invoice creation date realtime.

Currency There are 3 options for the type of currency that will be used in the invoice for transactions, namely IDR, USD, EUR.

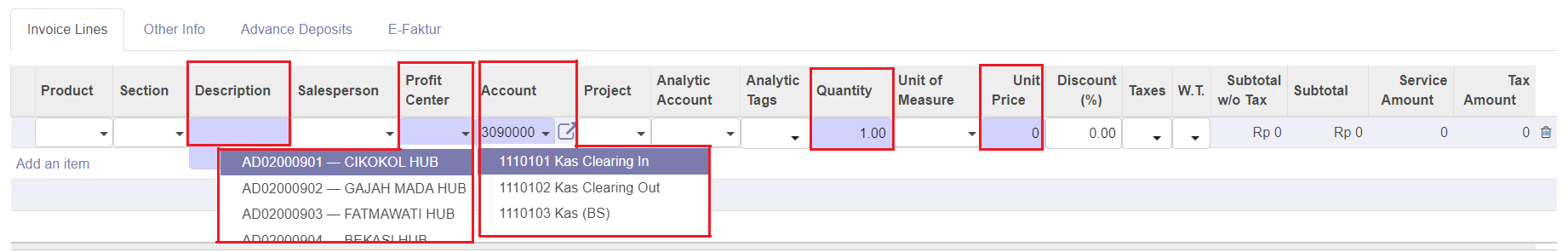

Invoice Line

In making a Customer Invoice, of course there will be transactions for a product / nominal, recording of products that will be made transactions based on a certain nominal will be recorded on the tab Invoice Line.

Description An explanation of the transaction made on the invoice line, however, will be automatically generated when the user inputs Product (because the product description has been set in the master data).

Profit Center The type of Profit Center / Cost Center that will affect and is used in making transactions against customer invoices that are made.

Account Account type that will be used to make transactions against customer invoices that are made.

Quantity The quantity / number of goods or types of transactions recorded on 1 transaction line on the invoice line.

Unit Price Nominal / unit price per product / on 1 transaction line which will be recorded on the invoice via the invoice line.

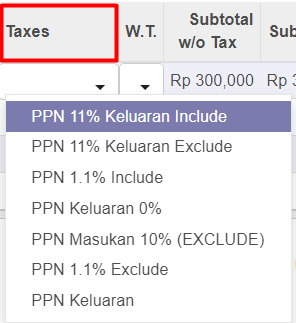

Taxes

In making an invoice line, the user can also add the type of tax that will be used in transactions per invoice line.

This tax calculation will be regulated in the Tax master data which will affect the nominal Subtotal.

INCLUDE This means that the calculated tax is included in the nominal price of the goods.

EXCLUDE This means that the tax calculated does not include the nominal price of the goods, so the calculation will be carried out and added based on the nominal price of the goods.

Only 1 Tax can be used in each invoice line.

Save

After the user fills in all the mandatory fields and adds an invoice line that contains transactions in the invoice, the Save button is used to save user input regarding the created invoice, and Discard when the user will discard all data that has been input.

Print Invoice

Export / print customer invoices with invoice line transactions that have been made before, will automatically download on the user's device in .pdf format using a template and KGX format.

Button Print Invoice will only appear when the user has saved changes/save the customer invoice.

Approve & Validate

Approve

Status akan berubah Draft Approved, and Validate/Post button will appear. In the Approved status, if the user wants to change or add an invoice line to a customer invoice, the user can use Set to Draft, so the status will return to Draft and the user can change the invoice line.

Validate

And when Validate, the invoice status will change from Approved Open.

User cannot change / add an invoice line when the status is Open, but the user can Cancel Invoice to cancel the validation so that the status changes to Cancelled,

Then Set to Draft to change the invoice and return the status to Draft.

E-Faktur

Customer Invoice can be used in making invoices, the previously generated invoice number will call the Customer Invoice number for Numbering, so that each Invoice has a different E-Faktur number.

Checkbox in Is eFaktur Exported will automated filled when the eFaktur number that contains a certain Customer Invoice is already exportedby the user and eFaktur Exported Date will be automatically filled in based on the date the user exported the eFaktur number.